Spiking stocks are easy to find but choosing the good ones from a huge bunch may be a bit tricky. You can simply check out the highest gainers each day and start trading them. However this way of trading can make you lose more money than you make. You always want to look for stocks that have real catalysts that show growth potential. In this article we will discuss why Invitae (NYSE: NVTA), BioAtla, Inc. (NASDAQ: BCAB) and Velo3D, Inc. (NYSE: VLD) are gaining the momentum they deserve. Get the hottest NYSE and NASDAQ Penny stocks with our 100% free alerts!

#1 SPINKING STOCKS : NVTA

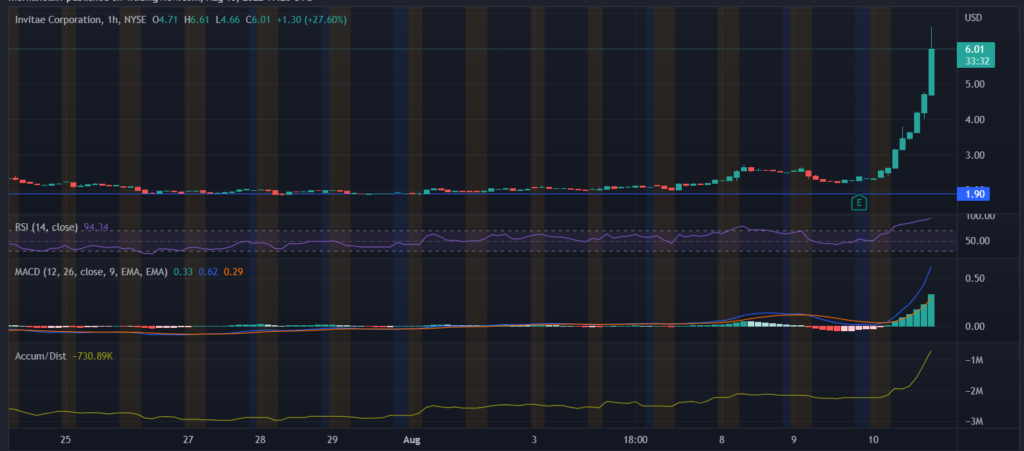

Upon reporting $136.6 Million in revenues, Invitae (NYSE: NVTA) is witnessing a major 106% run up this morning. As a medical genetics company, Invitae focuses on integrating genetic information into mainstream medicine. In order to improve the healthcare of patients in the US, Canada and globally.

On August 9, Invitae released its financial reports of Q2 2022 which shows a Year – Over – Year 17.5% in revenues totalling $136.6. Meanwhile GAAP gross profit reached $26.3 million and $737 cash on hand. However the company is operating at a net loss of $2.5 billion – a $10.87 net loss per share.

It is also worth noting that the company is initiating streamlining and cost reduction programs. It is expected to deliver $326 million in annualized cost savings by 2023 and extend the company’s cash runway until the end of 2024. That will be achieved through workforce reductions, portfolio optimization and restructuring its international presence.

With a 106% increase, the stock is currently trading at $6.18 which now serves as its new resistance. Additionally, NVTA stock has a strong support around 1.9.

Accumulation is drastically increasing and the MACD is on a recent bullish crossover with no signs of another crossover in the near future. RSI is at 94 indicating that the stock is extremely overbought at the moment.

#2 SPIKING STOCKS : BCAB

The second stock to make the spiking stocks list and our watchlist today is BioAtla, Inc. (NASDAQ: BCAB) with a 93.77% run up. As a globally renowned clinical-stage biotechnology company, BCAB works on providing preclinical development services, developing innovative reversibly active monoclonal antibodies and numerous other protein therapeutic product candidates.

Recently, the company announced its financial reports for the quarter ended June 30,2022. The report clearly shows a decrease in the net loss – currently operating at a net loss of $28.9 million compared to a net loss of $30.4 million. As well as an increase in research and development expenses and a decrease in general and administrative expenses.

In addition, BCAB is achieving notable progress in CAB-ADC programs and a number of other trials. Including the phase 2 Trial of Ozuriftamab Vedotin, phase 2 Trial of Mecbotamab Vedotin and phase 1/2 Dose-Escalation Trial of CAB-CTLA-4.

Following all of this great news, BCAB increased 83% and is currently being traded at $7.01 with a support near 3.37.

Accumulation is heavily fluctuating and the MACD is on a bullish crossover. Lastly, RSI is at 88 which indicates that the stock is extremely overbought. With the stock trading far from its support, this might not be a good entry point in BCAB stock. Did you miss out on this run? Sign up for our free alerts and never miss a run up again!

#3 SPIKING STOCKS : VLD

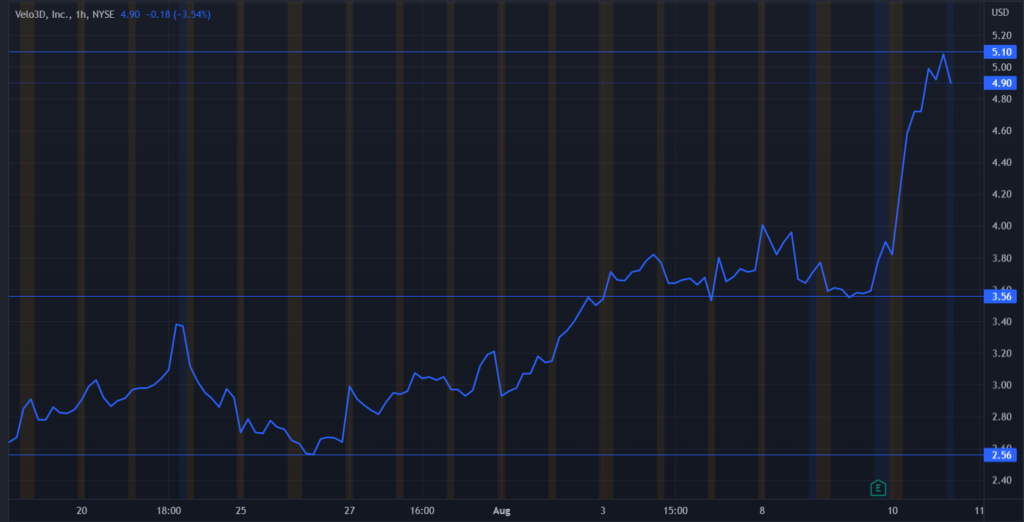

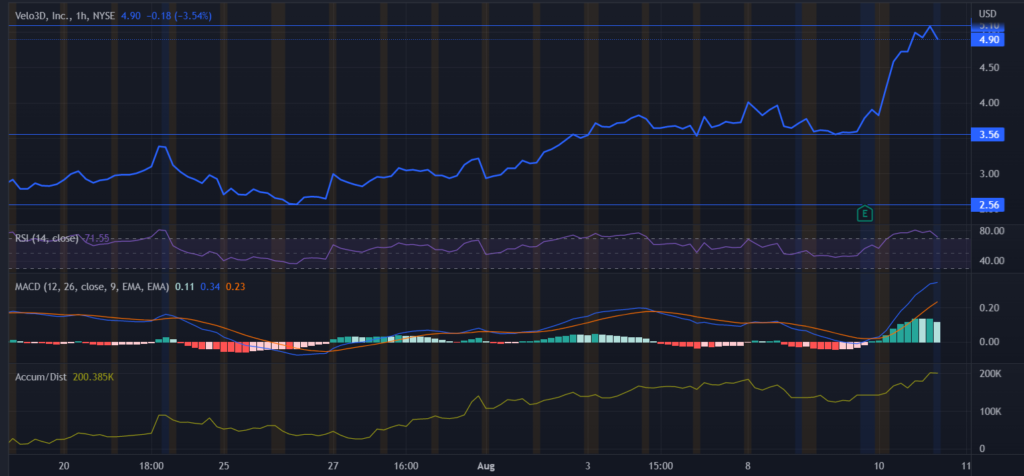

Last but surely not least is Velo3D, Inc. (NYSE: VLD) who is also currently gaining momentum for the release of its financial records of Q2 2022. VLD is a manufacturing technology company that produces mission-critical metal parts.

VLD reported a quarterly 60% increase in revenues totalling $19.6 million and over 160% YOY increase. The financial reports also showed a 6% increase in the gross margin over the last quarter. However the quarter’s operating expenses fell slightly to $27.5 million.

With $142 million in cash and investments at the end of the quarter, the company had a strong balance sheet. As a result, the company believes it has the liquidity to continue investing in technology while also providing the resources required to fund its growth plans. On that note, the company’s CEO – Benny Buller – said that

We have accomplished this while the revenue of our peers has been relatively flat over the same period. As a result, given our expected strength of our business in the second half of the year, it is possible that we will be the industry leader in metal additive manufacturing as we exit 2022, quicker than even we anticipated

VLD stock is currently trading at $4.9 with a newly established resistance at 5.1 and a primary support near 3.56 as well as a secondary support around 2.56.

Accumulation is drastically increasing and the MACD is on a bullish crossover. RSI is standing at 71 meaning that the stock is overbought.

BOTTOM LINE

With strong financial records, NVTA, BCAB and VLD are all showing great growth potential. These stocks all have the potential to make you great money if you time your entries and exits just right!

As always, good luck to all (except the shorts)!

WHEN VIRAL STOCKS HAS A STOCK ALERT, IT CAN PAY TO LISTEN. AFTER ALL, OUR FREE NEWSLETTER HAS FOUND MANY TRIPLE-DIGIT WINNERS FOR OUR SUBSCRIBERS. WE SPECIALIZE IN FINDING MOMENTUM BEFORE IT HAPPENS!

Disclosure: We have no business relationship with any company whose stock is mentioned in this article. Viral Stocks is not an investment advisor and this article does not provide investment advice. Always do your own research, make your own investment decisions, or consult with your nearest financial advisor. This article is not a solicitation or recommendation to buy, sell, or hold securities. This article is our opinion and is meant for informational and educational purposes only and does not provide investment advice. Past performance is not indicative of future performance.