Usually the same stocks that make the top day gainers list are the most volatile stocks, that’s not a coincidence. As any stock’s volatility increases, its chances of making (or losing) you more money increases. Accordingly, many investors tend to heavily trade volatile stocks with catalysts and growth potential.

In this article we will talk about Liberty Tripadvisor Holdings Inc. (NASDAQ: LTRPB), Qurate Retail, Inc. (NASDAQ: QRTEB) and Sentage Holdings Inc. (NASDAQ: SNTG). All of which made both the lists of most volatile and top gainers today! If you want to learn about the hottest NYSE and NASDAQ penny stocks before anyone else, sign up for our 100% free alerts!

#1 MOST VOLATILE STOCKS : LTRPB

With a 126% run up, Liberty Tripadvisor Holdings Inc. (NASDAQ: LTRPB) is on investors’ radar today. Liberty operates through its subsidiaries in the tourism industry and it works on connecting travelers with travel partners through its travel guidance platform. The platform also provides travelers with recommendations on where to stay, which sites to visit and the best dining places.

Liberty has a $181.06 million market cap – that’s an extremely low one – and a 52-week high of $93.67. This could mean that the run up might not be short lived as many believe and it still has a lot of room for growth before it hits its resistance.

However, some investors think that this could be a short squeeze, there isn’t concrete evidence to confirm or deny this theory. But it is worth mentioning that institutional investors own more than 50% of the company and around 5% of that number belong to hedge funds. Keeping in mind that not one single shareholder has significant control over Liberty as the 20 largest shareholders combined owns 50%.

Following the 126% increase, LTRPB stock is currently trading at $61.34 with a resistance at 78.26 and a primary support near 26 as well as a secondary one around 11.54.

Accumulation is drastically increasing and the MACD is on a recent bullish crossover. Whereas the RSI is at 75 indicating that the stock is overbought at the moment. Missed this run up? Never miss another one with our 100% free alerts on the best stocks to trade!

#2 MOST VOLATILE STOCKS : QRTEB

Qurate Retail, Inc. (NASDAQ: QRTEB) is an ecommerce company that operates through its subsidiaries in North America, Europe, and Asia. With a $1.47 billion market cap, QRTEB is a small cap stock, which basically means it has high volatility.

Recently, the company released its financial reports for the quarter ending June 30, which shows some losses in revenues and sales. However, considering the war in Ukraine and the global inflation, all retail companies have witnessed some hits. Currently, Qurate is already working on numerous plans and projects to regain its position in the market. On that note, the company’s CEO and President – David Rawlinson – said

We have already begun implementation of our turnaround plan and are pleased to report several key developments. First, we unveiled Project Athens in June, a three-year plan to re-establish revenue stability, margin expansion and incremental free cash flow generation at Qurate Retail. Second, we augmented our executive leadership talent with the addition of a President for our streaming business and a Chief Merchandise Officer for QVC US. We look forward to introducing these individuals soon.

He went on to add that there are many more factors that will help the company’s growth. There’s already signs of stabilization and Rawlinson is confident in the company’s “ ability to deliver on Project Athens from a bolstered balance sheet position, and we look forward to reporting future progress.” In addition, Qurate is monetizing its real estate assets in order to optimize the balance sheet, increase liquidity and reduce debts.

Currently trading at $11.67, QRTEB has a resistance around 18.92 and a primary support near 7.9. As well as a secondary stronger support around 4.19.

Accumulation is relatively stable, meaning that there are no new investors coming in yet the existing investors are bullishly holding on to their stocks.Meanwhile MACD is on a bullish crossover with no signs of another crossover anytime soo and RSI is holding at 57. Overall all indicators are showing good signs, which means that this might be a good entry point for bullish investors.

#3 MOST VOLATILE STOCKS : SNTG

The last stock to make the top gainers and most volatile stocks lists today is Sentage Holdings Inc. (NASDAQ: SNTG). Operating in China, the company provides an array of financial services including consumer loan repayment, collection management, prepaid payment network services and loan recommendations. It’s also worth noting that SNTG has a market cap of $2.47 billion, indicating that its a volatile small cap stock

Last month, Sentage released its financial results for the fiscal year ending December 2021. The reports show a net loss of $1.09 million – compared to a net loss of $1.59 million for fiscal year 2020 and the basic and diluted loss per share has reached $0.09 – compared to $0.16 loss in 2020.

On the other hand, the total operating revenue decreased 37.1% to $2.26 million, this was primarily caused by the completion of the outstanding servicing agreements under the consumer loan repayment and collection management business and its revenues were notably reduced in 2021.

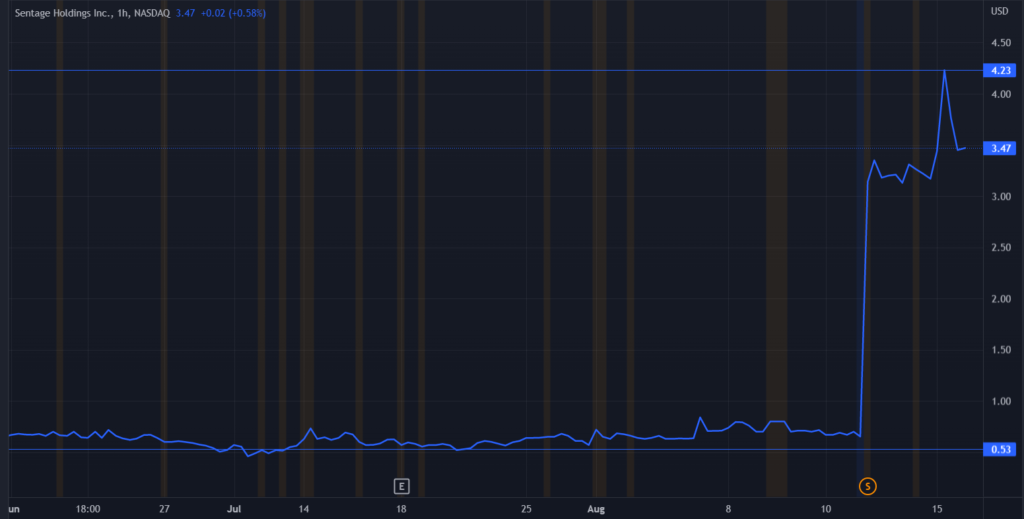

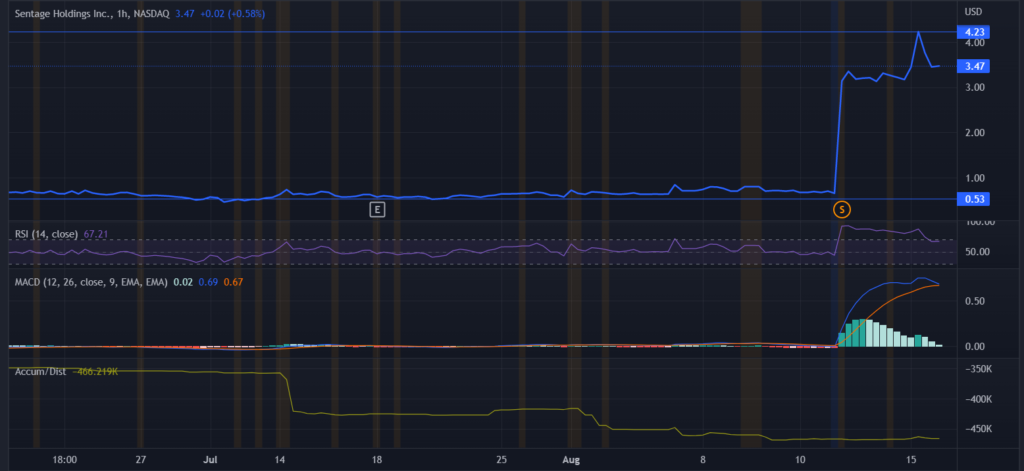

With a 15% increase, SNTG is currently valued at $3.47 with a newly established resistance around 4.23 and a support nearing .53.

Accumulation is trending downwards and RSI is at 67 indicating that the stock is slightly overbought. Lastly MACD is on a bullish crossover but another crossover might happen in the near future.

BOTTOM LINE

Trading the most volatile stocks might be a big risk but the potential rewards could be worth it. LTRPB, QRTEB and SNTG are all hitting new highs and growing tremendously fast, this might not be the time to chase but with their low market caps any catalyst might help these stocks break their resistances and trade at all time highs.

As always, good luck to all (except the shorts)!

WHEN VIRAL STOCKS HAS A STOCK ALERT, IT CAN PAY TO LISTEN. AFTER ALL, OUR FREE NEWSLETTER HAS FOUND MANY TRIPLE-DIGIT WINNERS FOR OUR SUBSCRIBERS. WE SPECIALIZE IN FINDING MOMENTUM BEFORE IT HAPPENS!

Disclosure: We have no business relationship with any company whose stock is mentioned in this article. Viral Stocks is not an investment advisor and this article does not provide investment advice. Always do your own research, make your own investment decisions, or consult with your nearest financial advisor. This article is not a solicitation or recommendation to buy, sell, or hold securities. This article is our opinion and is meant for informational and educational purposes only and does not provide investment advice. Past performance is not indicative of future performance.