Many investors and traders are happy to put 2021 behind them and focus on the New Year. Small caps started 2021 off on a positive note but failed to find much follow-through in the latter part of the year. Meme stocks like AMC and GME finished the year well of the highs and popular SPACs like CLOV got killed.

The good news is that the New Year allows investors to put the past behind and start with a clean slate. We here at Viral Stocks aren’t in love with any particular plays. We look for low float momentum plays that can deliver big gains in a matter of hours to days.

There are plenty of opportunities for our subscribers in Nasdaq and NYSE penny stocks with low floats, news, and a significant short position.

Smart investors know that if you want to make the big money off a small account, the place to be is in penny stocks. There are many good Nasdaq and NYSE penny stocks that can boost your portfolio’s value in the long term. For investors, we preach the key to trading penny stocks is finding momentum BEFORE it happens and ahead of the crowd.

We alert our subscribers with our best ideas before our regular readers. This is the value of having a subscription to Viral Stocks, which you can sign up for here.

If you watch the Viral Stocks YouTube channel, you can get a sense of what we look for in identifying hot Nasdaq and NYSE stocks.

In this article, we look at 3 Nasdaq stocks that started the year strong. They are Genprex Inc (NASDAQ: GNPX), Immix Biopharma (NASDAQ: IMMX), and Indaptus Therapeutics (NASDAQ: INDP).

GNPX

GNPX announced at 8:00am Monday morning that the FDA granted Fast Track Designation (FTD) for the Company’s lead drug candidate, REQORSA™ Immunogene Therapy, in combination with Merck & Co’s Keytruda® in patients with histologically confirmed unresectable stage III or IV non-small cell lung cancer (NSCLC) whose disease progressed after treatment with Keytruda.

In the first quarter of 2022, Genprex expects to initiate its Acclaim-2 clinical trial, which is an open-label, multi-center Phase 1/2 clinical trial evaluating REQORSA in combination with Keytruda, for this patient population. The Company previously received its first FTD for REQORSA in combination with AstraZeneca PLC’s Tagrisso® in patients with histologically confirmed unresectable stage III or IV NSCLC, with EGFR mutations that progressed after treatment with Tagrisso.

“We are thrilled to receive a second Fast Track Designation from the FDA for REQORSA in patients with late-stage NSCLC, this time in combination with the checkpoint inhibitor Keytruda,” said Rodney Varner, President and Chief Executive Officer at Genprex. “This Fast Track Designation is an important step in our efforts to accelerate clinical development of REQORSA and another validation of the potential of REQORSA to treat the unmet medical need of patients with late-stage NSCLC. With a strong balance sheet of $42 million in cash as of the end of the third quarter of 2021 and expert clinical trial management led by Chief Medical Officer and industry veteran Mark Berger, MD who joined Genprex in September 2021, we are well-positioned to advance our Acclaim-1 and Acclaim-2 clinical trials in a meaningful way in 2022.”

GNPX is the type of play we look for.

- News before the bell

- 4.83% of the float short

- Under $100 million market cap

As you can see, GNPX opened at the low of the day and took off from there. GNPX is trading over $4 in the after-hours.

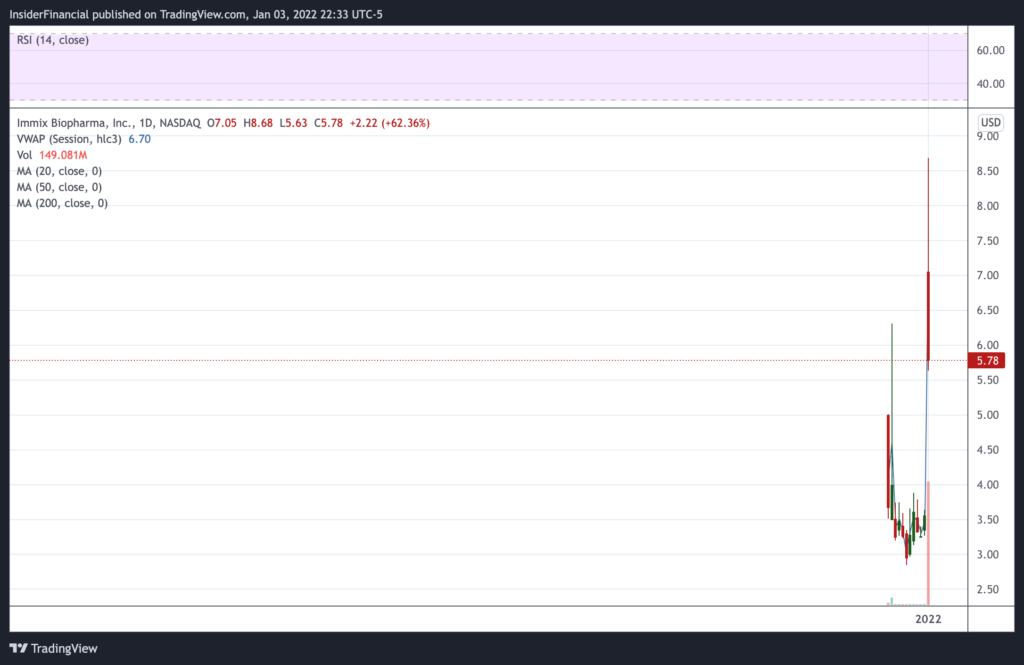

IMMX

IMMX is a recept IPO that started trading last month at $5. The stock has traded below that price up until yesterday when the company announced that the FDA granted the Rare Pediatric Disease (RPD) designation for IMX-110, a cancer candidate targeted at children.

FDA’s RPD for IMX-110 relates to rhabdomyosarcoma, a potentially fatal form of pediatric cancer in children, and the experimental therapy is currently undergoing a Phase 1b/2a clinical trial.

In awarding RPD, the federal agency picks drug candidates targeted at serious and life-threatening diseases affecting less than 200K individuals in the U.S. with a primary impact on children aged 18 years or younger.

If the drugs with the RPD wins approval from the FDA, the sponsor of its marketing application is entitled to receive a Priority Review Voucher (PRV) from the regulator. The PRV can be redeemed to receive priority review for any subsequent marketing application, or it can be sold or transferred.

After opening at $7 and running to over $8, the close under $6 was rather disappointing. We will be watching and updating for opportunities in IMMX.

INDP

INDP is a great chart setup.

- Market cap just $49 million

- 4.18 million shares outstanding

- 200k share float

- 83% off 52-week high

- Social media chatter

- PR

INDP announced the appointment of Dr. Boyan Litchev, M.D., as Chief Medical Officer, effective January 31, 2022. Dr. Litchev will oversee clinical strategy, clinical development, and the conduct of all clinical programs and will report directly to Jeffrey A. Meckler, Chief Executive Officer of Indaptus.

Something is brewing in INDP. After closing at $6.17, shares are bidding over $7 in the afterhours. We could see fireworks on Tuesday in INDP.

Bottom Line

All of the 3 NASDAQ stocks discussed today have already shown explosive moves. We look for NASDAQ stocks that have yet to make their explosive move. There are plenty of opportunities, and we take our time to monitor hundreds of penny stocks to buy each week, trying to find the best alerts for our subscribers.

We run screens every morning looking for news on low float runners that can squeeze the shorts. Our alerts come at the opening bell allowing everyone to participate equally. This is why it’s so important to be signed up for BOTH email and SMS alerts. Alerts can be time-sensitive and you don’t want to miss the next hot runner.

Remember, it’s all about consistency. Our track record speaks for itself. For years, we have provided a FREE service to tens of thousands of traders.

As always, good luck to all (except the shorts)!

WHEN VIRAL STOCKS HAVE A STOCK ALERT, IT CAN PAY TO LISTEN. AFTER ALL, OUR FREE NEWSLETTER HAS FOUND MANY TRIPLE-DIGIT WINNERS FOR OUR SUBSCRIBERS. WE SPECIALIZE IN FINDING MOMENTUM BEFORE IT HAPPENS!

Disclosure: We have no position in any of the securities mentioned. We wrote this article ourselves and it expresses our own opinions. We are not receiving compensation for it. We have no business relationship with any company whose stock is mentioned in this article. Viral Stocks is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This article is not a solicitation or recommendation to buy, sell, or hold securities. This article is meant for informational and educational purposes only and does not provide investment advice.

Image by Gerd Altmann from Pixabay