There are many reasons why a stock can skyrocket, but these 3 related stocks are running up with no clear catalysts. Is that a good or a bad sign? Let’s dig deeper on each one of these emerging stocks to learn if they are truly valuable or is it another pump and dump. The emerging stocks we are talking about today are AMTD IDEA Group (NYSE: AMTD), AMTD Digital Inc. (NYSE: HKD) and 36Kr Holdings Inc. (KRKR). Don’t forget to sign up for our free alerts so you never miss a run up!

#1 EMERGING STOCKS : HKD

AMTD Digital (NYSE: HKD) is a digital platform that works on providing financial, media, content and marketing, and investment solutions. HKD stock was minted on July 15 and since then the stock has been gaining a lot of momentum. While that should be a great thing but with no clear reason or catalyst on the run up investors are getting weary.

In the first month of its trading the stock went up 17,000%, the volatility is not really understood. Especially because the company hasn’t come up with any news or even tweets since then.

With reddit and fintwit taking an interest in HKD, some investors believe that this could be a meme stock. However there is also no proof to these claims, simply there is no known reason for this stock to grow this much that quick.

It is also worth mentioning that AMTD Digital’s market capitalization ballooned to $342.64 billion on August 1 which makes it more valuable than 480 of the S&P 500’s SPX. On the same day, the company issued a press release thanking its investors on the successful completion of its IPO. Where the company clearly stated that it also does not understand what’s going on by saying

During the period since our initial public offering, the Company noted significant volatility in our ADS price and also observed some very active trading volume. To our knowledge, there are no material circumstances, events nor other matters relating to our Company’s business and operating activities since the IPO date.

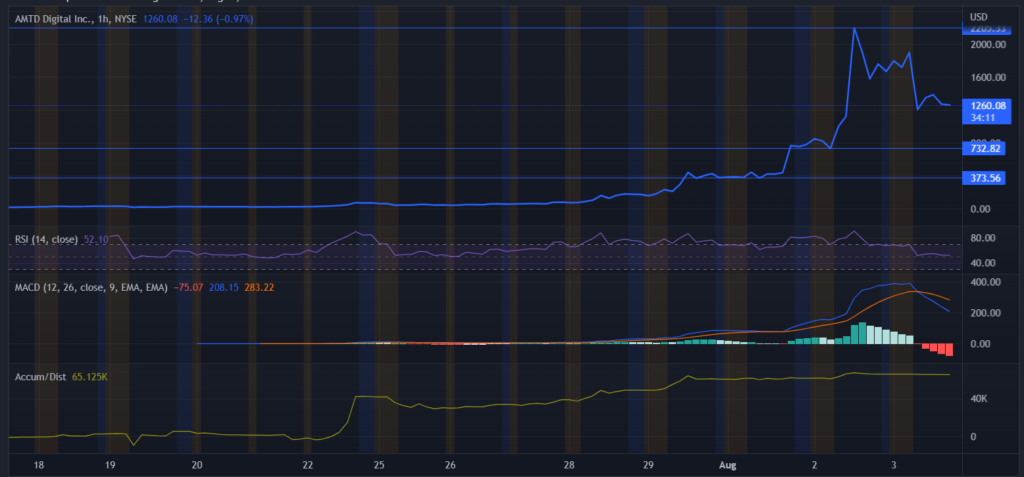

Today, the stock is slowing down a little but it’s still trading much higher than it was when it first entered the market. Currently, HKD Stock is being traded at $1272 with a newly formed resistance at 2205 and a primary support around 732 as well as a secondary one near 373.

RSI is holding at 52 which is a good indicator, however the MACD is on a recent bearish crossover. Lastly, accumulation has been steadily increasing over the past week which could mean that many investors are holding on to their stocks as they believe that HKD stock can go even higher.

All of this resulted in HKD’s parent company – AMTD Idea Group – also gaining momentum and reaching new highs! Keep on reading to learn more about these stocks and sign up for our free alerts to get the next runners before anyone else!

#2 EMERGING STOCKS : AMTD

As the number one independent investment banking firm in Hong Kong and Asia, AMTD Idea Group (NYSE: AMTD) works on investment banking, asset management, and strategic investment. It also offers a collection of investment banking services and advisory services.

As previously mentioned, the company has been gaining attention thanks to its subsidiary’s stock – HKD – skyrocketing. Resulting in AMTD stock itself going on a major run up. Although this increase might not last for long, AMTD is a company with major growth potential.

For instance the company has managed to report strong financial reports for the fiscal year ending December 2021 despite the Covid-19 effect on global markets. In fact its financial report showed a 25% increase in revenues, over 32% increase in profits and a 53.7% decrease in finance costs. On that note, let’s take a look at the technical analysis of AMTD stock.

AMTD is also cooling down a little after its major run and is currently trading at $6,06 with a new resistance at 11.21. The stock has a primary support around 11.21 and a secondary support near 1.02.

RSI is holding at 48 but on the other hand accumulation is trending downwards and MACD is on a bearish crossover.

#3 EMERGING STOCKS : KRKR

The last stock is 36Kr Holdings Inc. (NASDAQ: KRKR) and its relation with other stocks is a bit more complicated. Last February AMTD Idea Group announced its entrance into the metaverse sector through SpiderNet World.

Placed in the Metaverse, the SpiderNew World will feature a number of districts – business, knowledge, social, entertainment and lifestyle districts. As a company that provides marketing, advertising and content creation services, KRKR will join the SpiderNew World’s Knowledge district.

KRKR and AMTD will work closely together to provide advice for young entrepreneurs on Metaverse entry and give them the knowledge needed to succeed in Web 3.0.

Although the relation between the two companies may not seem that vital. But over the past three trading days, the stock has been witnessing an increase in its value with no direct catalyst. Which raises the question: is KRKR surging due to AMTD and HKD? Some fintwit investors believe so but there is no real data to support that claim, it might be just a well-timed conicende.

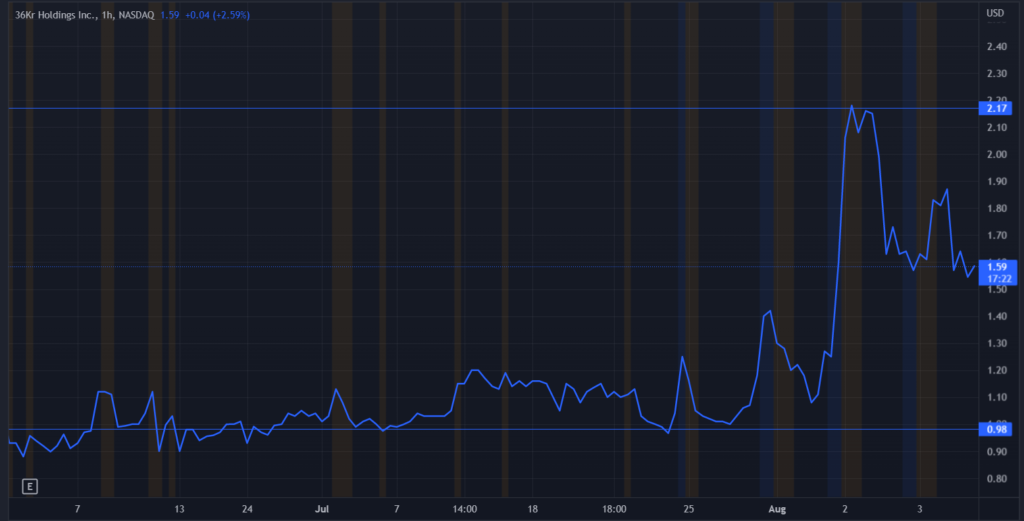

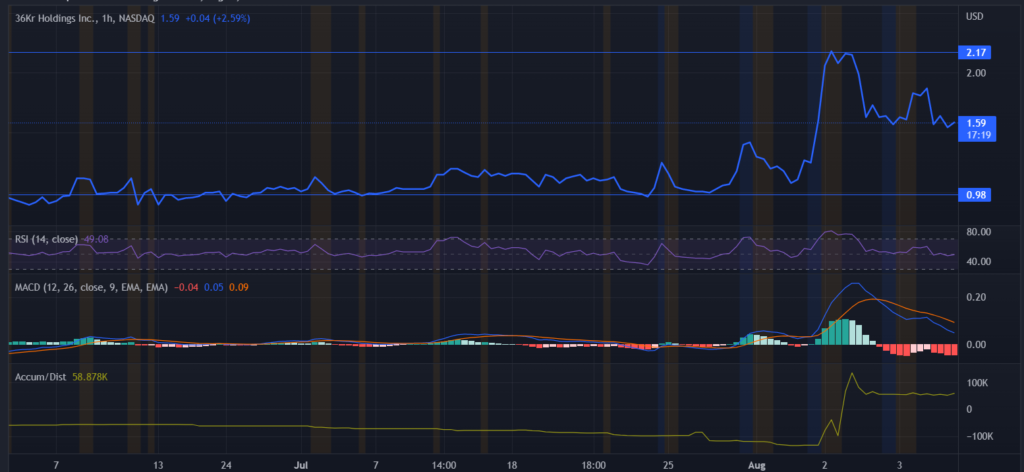

Over the past quarter KRKR has increased 44% and is currently trading at $1.59 with a resistance around 2.17 and a support near 0.98.

Meanwhile RSI is at 49 and accumulation is steadily increasing. However the MACD is on a recent bearish crossover.

Bottom Line

All three stocks are showing growth potential especially through the SpiderNet World project that connects them all together. However the companies are yet to release more news or updates.

Emerging stocks are a risk and emerging volatile stocks are even a bigger risk so if you weren’t among the lucky ones who bought HKD from the very beginning and have now won the lottery, you should consider carefully when to enter and exit!

As always, good luck to all (except the shorts)!

WHEN VIRAL STOCKS HAS A STOCK ALERT, IT CAN PAY TO LISTEN. AFTER ALL, OUR FREE NEWSLETTER HAS FOUND MANY TRIPLE-DIGIT WINNERS FOR OUR SUBSCRIBERS. WE SPECIALIZE IN FINDING MOMENTUM BEFORE IT HAPPENS!

Disclosure: We have no business relationship with any company whose stock is mentioned in this video. Viral Stocks is not an investment advisor and this video does not provide investment advice. Always do your own research, make your own investment decisions, or consult with your nearest financial advisor. This video is not a solicitation or recommendation to buy, sell, or hold securities. This video is our opinion and is meant for informational and educational purposes only and does not provide investment advice. Past performance is not indicative of future performance.