Chinese Stocks are making quite the comeback this year, most days at least one of the top stocks gainers is a chinese stock! In fact just today these 2 stocks made their shareholders tons of money Ostin Technology Group (NASDAQ: OST) and Meihua International Medical Technologies (NASDAQ: MHUA).

Many investors stay far away from foreign stocks but trading any stock is essentially the same. If you do your due diligence and know what the company’s worth then you should confidently get on board! Don’t have time to do your own DD? No worries, sign up to our free alerts and we’ll let you know which NASDAQ and NYSE Penny stocks to hitch your wagon on!

#1 Chinese Stocks To Buy: OST

As a well-known supplier of display modules and polarizers, Ostin Technology Group (NASDAQ: OST) works on designing, developing and manufacturing a wide array of distinctive TFT-LCD display modules. Which are used in consumer electronics automotive displays and outdoor LCD displays.

The OST stock is on a 50% run up today which could be traced back to its recent announcement. On July 28, the company announced it has secured a number of purchase orders for its LCD/TP display modules. The aggregate value of the whole purchase is RMB17.64 million – around $2.6 million. Ostin is planning on delivering all the products by the end of the year.

It is also worth mentioning that the display modules are expected to be used in iGame G-ONE Plus. The iGame series products are very popular among gamers all over the world. That exposure might benefit the company and its stock.

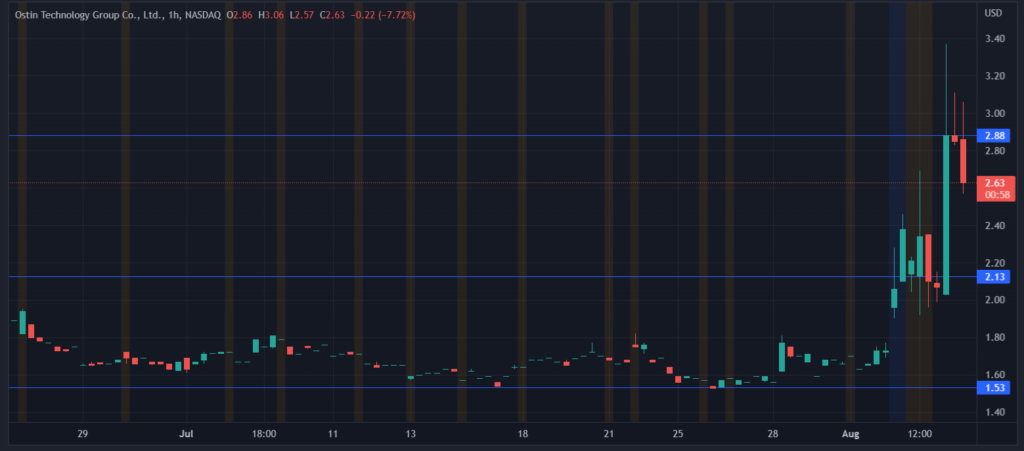

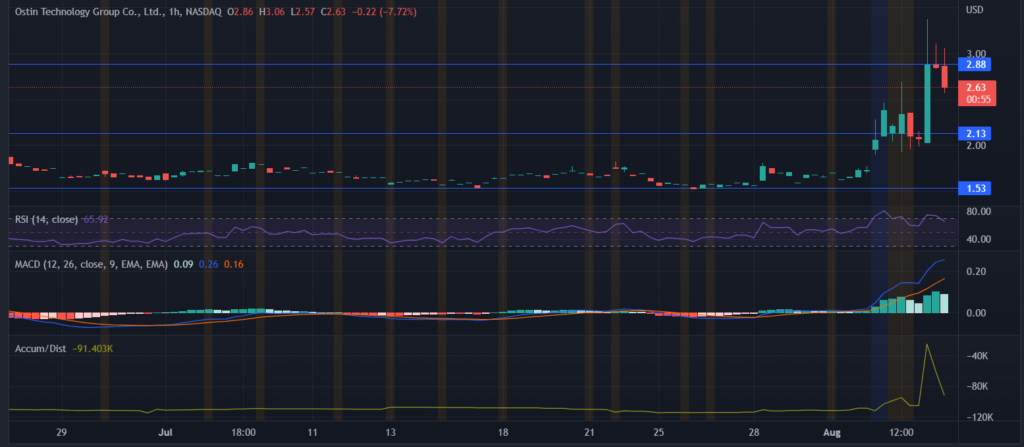

Following the 50% increase today, OST is currently being traded at $2.63 with a resistance around 2.88. The stock has a primary support near 2.13 and a stronger secondary one at 1.53.

The MACD is on a bullish crossover but on the other hand accumulation is trending downwards. Meanwhile the RSI is at 65 indicating that the stock is slightly overbought at the moment.

This run up might not be a good entry point. Keeping in mind that with Ostin delivering the order, the stock might break its resistance and trade at its May high of $4.8. Sign up for our free alerts now so you don’t miss out on the next run up!

#2 Chinese Stocks To Buy: MHUA

Upon the release of its financial reports, MHUA saw a 25% increase. Meihua International Medical Technologies (NASDAQ: MHUA) is a renowned manufacturer and provider of disposable medical devices. For example the company produces eye drops bottles, medicine bottles and anal bags.

This morning, Meihua released its financial reports for the fiscal year ending December 2021. The report shows the high potential of the company moving forward. Revenues of Meihua increased 16.8% YOY reaching $104.04 million and the net income increased 4.99% to $20 million. The gross profit also increased by 7% to $39.81 million. Meanwhile the gross margin decreased to 38.26% from the 47% of the previous year. Lastly, Meihua’s income from operations increased 7.8% to $25.3 million.

On that note, the company’s Chairman – Yongjun Liu – said

During the past year COVID-19 still hangs over the world and poses many new challenges and opportunities to the economy and the medical industry in various countries. Thanks to our extensive product offerings, a strong upstream and downstream supply chain system and technical upgrades to our equipment and production capacity, our total sales increased to more than $100 million, representing a growth rate of over 16% from 2020.

He went on to add that Meihua is working on maintaining a healthy cash flow reserves. In order to be able to improve their production and marketing efforts.

Additionally, the company is planning on completing the construction of its new factory. The factory is expected to start producing Covid-19 detection and prevention products in 2022. This could help position the company among the leading medical device suppliers.

With a 27% increase, MHUA is trading at $6.59 with a newly formed resistance around 10 and a primary support near 5.16 as well as a secondary one at 3.98.

MACD is on a recent bearish crossover, meanwhile the RSI is at 39 indicating that the stock is oversold at the moment. Lastly, accumulation is heavily fluctuating today. Although most of the indicators are showing negative signs at the moment, that’s just the market’s normal reaction to a tremendous run up.

This might even be a good entry point for bullish investors. With the company’s potential and expected catalysts, the stock might witness higher runs in the near future to be traded at its 52 week high of $14.8.

Bottom Line

The Chinese stocks are emerging this year and regaining their position in the market. There are even more Chinese stocks that are seeing tremendous growth today including 36Kr Holdings Inc. (NASDAQ: KRKR), United Time Technology Co., Ltd. (NASDAQ: UTME) and Meta Data Limited (NYSE: AIU).

Wanna find the BEST NASDAQ & NYSE Penny Stocks? We’ve got your back!

As always, good luck to all (except the shorts)!

WHEN VIRAL STOCKS HAS A STOCK ALERT, IT CAN PAY TO LISTEN. AFTER ALL, OUR FREE NEWSLETTER HAS FOUND MANY TRIPLE-DIGIT WINNERS FOR OUR SUBSCRIBERS. WE SPECIALIZE IN FINDING MOMENTUM BEFORE IT HAPPENS!

Disclosure: We have no business relationship with any company whose stock is mentioned in this video. Viral Stocks is not an investment advisor and this video does not provide investment advice. Always do your own research, make your own investment decisions, or consult with your nearest financial advisor. This video is not a solicitation or recommendation to buy, sell, or hold securities. This video is our opinion and is meant for informational and educational purposes only and does not provide investment advice. Past performance is not indicative of future performance.