Nasdaq biotechs

So far, 2022 has not shaped up to be as good as everyone thought it would be. We can all thank JPow for knocking the wind out of the markets. Expectations are for 4 Fed rate hikes this year along with QT “quantitative tightening” as the Fed reduces its balance sheet.

While the macro picture isn’t looking so hot right now, there are plenty of opportunities in low-float Nasdaq plays with catalysts. These are the type of plays we here at Viral Stocks specialize in.

There are plenty of opportunities for our subscribers in Nasdaq and NYSE penny stocks with low floats, news, and a significant short position.

Smart investors know that if you want to make the big money off a small account, the place to be is in penny stocks. There are many good Nasdaq and NYSE penny stocks that can boost your portfolio’s value in the long term. For investors, we preach the key to trading penny stocks is finding momentum BEFORE it happens and ahead of the crowd.

We alert our subscribers with our best ideas before our regular readers. This is the value of having a subscription to Viral Stocks, which you can sign up for here.

If you watch the Viral Stocks YouTube channel, you can get a sense of what we look for in identifying hot Nasdaq and NYSE stocks.

Nasdaq Biotechs

Biotech stocks trading on the Nasdaq are some of the best opportunities for investors. These biotechs love to drop PRs that can send their stocks flying. Keep in mind though that many of these are just trades as small-cap biotechs love to do offerings when their stocks are running.

You don’t want to become a bagholder!

The good news is that we avoid these pitfalls for our subscribers and navigate them through the rough and tumble world in trading small-cap biotechs.

In this article, we take a look at 3 hot Nasdaq biotechs. They are BioCryst Pharmaceuticals (NASDAQ: BCRX), Immix Biopharma (NASDAQ: IMMX), and Lixte Biotechnology Holdings (NASDAQ: LIXT).

Nasdaq Biotechs #1 BCRX

BCRX ran 27% to start the trading week. BCRX just needs to close above $16 and then the stock can challenge the 52-week high of $18.48.

BCRX jumped after the company announced preliminary, unaudited ORLADEYO® (berotralstat) revenue for the fourth quarter and full-year 2021 and provided new guidance for full-year 2022 ORLADEYO net revenue and expected peak ORLADEYO sales.

“Following 12 months of a successful launch through a global pandemic, we have a clear picture of the continued commercial trajectory for ORLADEYO based on a very attractive product profile, leading to strong patient demand to switch from injectable therapies to our oral, once-daily medicine, with 70 percent patient retention through the first year. Building on our substantial 2021 patient base, we are confident that ORLADEYO will achieve no less than $250 million of net revenue in 2022 and that ORLADEYO will become the market leader as the most prescribed prophylactic therapy with peak sales of $1 billion,” said Jon Stonehouse, president and chief executive officer of BioCryst.

Why does this matter?

BCRX has a current market cap of just $2.86 billion. If Orladeyo can do $1 billion in sales, BCRX stock is very, very cheap at current levels, especially when you consider that BCRX did just $114 million in sales last year.

Furthermore, BCRX is also enrolling patients into clinical trials with BCX9930, an experimental treatment for paroxysmal nocturnal hemoglobinuria. We will know if the trial was a success before the end of 2022.

Nasdaq Biotechs #2 LIXT

Shares of LIXT are up 92% over the past 5 trading days. This comes after the company put out big cancer-treating news.

In preclinical studies its lead clinical compound, LB-100, a protein phosphatase (PP2A) inhibitor, was found to increase the responsiveness of diverse cancers to immunotherapy.

Lixte’s founder and CEO, John S. Kovach M.D, commented that “recent advances in therapy with immune checkpoint inhibitors have been a true breakthrough in the development of more effective and less toxic treatment for many cancers. Unfortunately, most cancer patients do not respond to immunotherapy. There are widespread efforts to find pharmacologic and/or immunologic ways to turn unresponsive (‘cold’) tumors into responsive (‘hot’) tumors. Cancers with a molecular abnormality termed microsatellite-instability (MSI) stemming from a defect in a DNA repair enzyme are generally ‘hot’ tumors, that is, tumors responsive to immunotherapy. Yen and colleagues now report that pharmacologic inhibition of PP2A by LB-100 modifies two distinct molecular pathways resulting in conversion of microsatellite stable (MSS) tumors into MSI tumors sensitive immune checkpoint blockade therapy.”

We really like LIXT because there are just 4.52 million shares in the float and has just a $35 million market cap. Furthermore, LIXT has a 52-week high of just over $7. It won’t take much volume to get LIXT running and back to the highs.

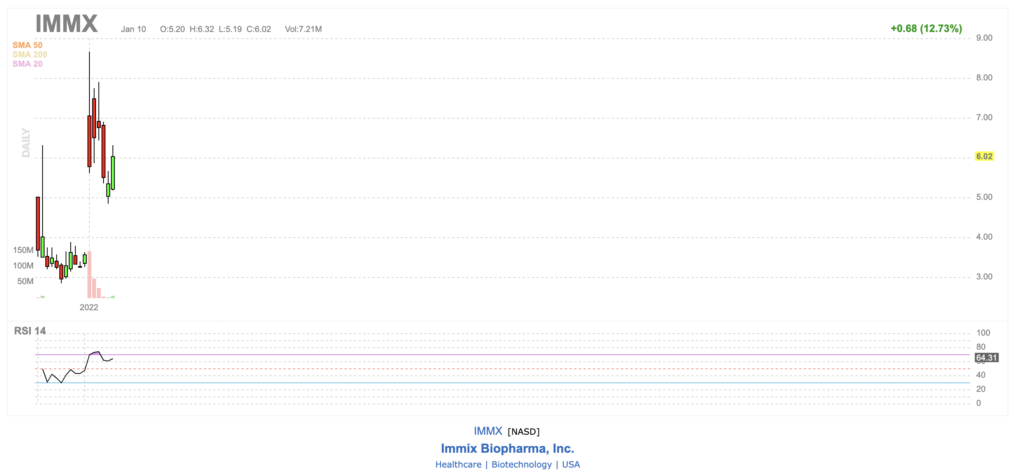

Nasdaq Biotechs #3 IMMX

IMMX is one that we talked about last week, which you can read here. After dipping below $5, IMMX is up over 20% to close just above $6.

Investors got excited about IMMX last week after the company announced that the FDA granted the Rare Pediatric Disease (RPD) designation for IMX-110, a cancer candidate targeted at children.

FDA’s RPD for IMX-110 relates to rhabdomyosarcoma, a potentially fatal form of pediatric cancer in children, and the experimental therapy is currently undergoing a Phase 1b/2a clinical trial.

In awarding RPD, the federal agency picks drug candidates targeted at serious and life-threatening diseases affecting less than 200K individuals in the U.S. with a primary impact on children aged 18 years or younger.

If the drugs with the RPD wins approval from the FDA, the sponsor of its marketing application is entitled to receive a Priority Review Voucher (PRV) from the regulator. The PRV can be redeemed to receive priority review for any subsequent marketing application, or it can be sold or transferred.

We said in our last profile:

After opening at $7 and running to over $8, the close under $6 was rather disappointing. We will be watching and updating for opportunities in IMMX.

That dip below $5 was the opportunity we were looking for. With just 4.12 million shares in the float, look for IMMX to get hot again.

Bottom Line

All of the 3 NASDAQ stocks discussed today have already shown explosive moves. We look for NASDAQ stocks that have yet to make their explosive move. There are plenty of opportunities, and we take our time to monitor hundreds of penny stocks to buy each week, trying to find the best alerts for our subscribers.

We run screens every morning looking for news on low float runners that can squeeze the shorts. Our alerts come at the opening bell allowing everyone to participate equally. This is why it’s so important to be signed up for BOTH email and SMS alerts. Alerts can be time-sensitive and you don’t want to miss the next hot runner.

Remember, it’s all about consistency. Our track record speaks for itself. For years, we have provided a FREE service to tens of thousands of traders.

As always, good luck to all (except the shorts)!

WHEN VIRAL STOCKS HAVE A STOCK ALERT, IT CAN PAY TO LISTEN. AFTER ALL, OUR FREE NEWSLETTER HAS FOUND MANY TRIPLE-DIGIT WINNERS FOR OUR SUBSCRIBERS. WE SPECIALIZE IN FINDING MOMENTUM BEFORE IT HAPPENS!

Disclosure: We have no position in any of the securities mentioned. We wrote this article ourselves and it expresses our own opinions. We are not receiving compensation for it. We have no business relationship with any company whose stock is mentioned in this article. Viral Stocks is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This article is not a solicitation or recommendation to buy, sell, or hold securities. This article is meant for informational and educational purposes only and does not provide investment advice.

Image by PublicDomainPictures from Pixabay