Nasdaq penny stocks

Nasdaq penny stocks are heating up again as Mr. Market ignores the recent hot inflation data and focuses on catalyst-driven events. We have said repeatedly here at Viral Stocks that the place to be during these volatile times is in Nasdaq and NYSE penny stocks.

For us at Viral Stocks, our focus is on individual names that are not geared towards the wider market. By focusing on microeconomic factors rather than macro headwinds, investors can outperform the markets. There are plenty of opportunities for our subscribers in Nasdaq and NYSE penny stocks with low floats, news, and a significant short position.

Smart investors know that if you want to make the big money off a small account, the place to be is in penny stocks. There are many good Nasdaq and NYSE penny stocks that can boost your portfolio’s value in the long term. For investors, we preach the key to trading penny stocks is finding momentum BEFORE it happens and ahead of the crowd.

We alert our subscribers with our best ideas before our regular readers. This is the value of having a subscription to Viral Stocks, which you can sign up for here.

If you watch the Viral Stocks YouTube channel, you can get a sense of what we look for in identifying hot Nasdaq and NYSE stocks.

In this article, we take a look at 3 Nasdaq penny stocks heating up. They are G Medical Innovation Holdings (NASDAQ: GMVD), Nxt-ID (NASDAQ: NXTD), and Phunware (NASDAQ: PHUN).

Nasdaq Penny Stocks #1 GMVD

GMVD is already up 77% year-to-date, but we think this one still has gas in the tank.

This comes as GMVD is set to manufacture several million U.S. FDA Emergency Use Authorization (EUA) approved COVID-19 PCR collection test kits available for retailers for sale by the end of January 2022.

GMVD is now accepting orders for the co-branded LiveNow PCR Collection Kit, which will retail for $9.99. The diagnostic PCR (polymerase chain reaction) test detects the presence or absence of SARS-CoV2, the virus that causes COVID-19. Users register with the lab online, collect a nasal swab sample at home, and send the sample to G Medical’s CLIA-certified lab with the pre-paid return pack. On average, tests results are expected to be available online within 24 hours from the time the sample is received.

G Medical’s labs are approved by the FDA under the EUA. Currently, G Medical has two CLIA-certified labs; one in Southern California, and the other in North Carolina. In addition, G Medical has launched six testing centers in California, with many more planned. G Medical’s labs are capable of being run 24 hours per day 7 days a week, and can each process up to 24,000 COVID tests per hour to meet the current demand.

The first test kit order is for 4 million units. G Medical will be selling these units wholesale for $3.25 each, reflecting a gross profit of $7 million. Additionally, G Medical expects to be paid an average of $85.00 per test through each patient’s insurance.

This is just the first order and the company makes $7 million. This is impressive considering GMVD has a market cap of just $34 million. With just 8 million shares in the float, we see GMVD at new highs sooner than later.

Nasdaq Penny Stocks #2 NXTD

NXTD is a prime short-squeeze play with 15% of its 6.82 million share float short.

NXTD is a top cybersecurity company that has been beaten down by the shorts. However, with the rise of the WallStreetBets crowd and its army of Apes, retail investors have figured out how to beat “Old Wall Street” at their own game with the gamma short squeeze.

A gamma squeeze can happen when there’s widespread buying activity of short-dated call options for a particular stock. This can effectively create an upward spiral in which call buying triggers higher stock prices, which results in more call buying and even higher stock prices.

We see NXTD as a prime gamma squeeze candidate, especially with the high short position in the stock and the low float.

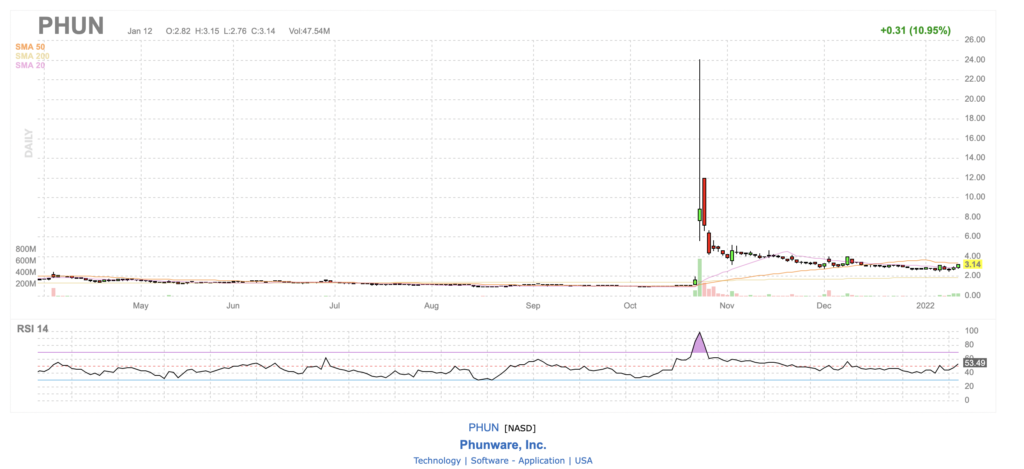

Nasdaq Penny Stocks #3 PHUN

PHUN starts running whenever there’s buzz around President Trump and his SPAC DWAC. As you can see from the charts below, the moves have been similar.

We’re covering PHUN because it’s a Nasdaq penny stock while DWAC trades just above $70.

PHUN specializes in creating mobile applications which allow brands to create personalized ad targeting programs so that advertisers know what content will be most appealing when it comes time to advertise products through these means.

During the 2020 presidential election, Phunware joined hands with the Trump campaign for “the development, launch and ongoing management and evolution of the Trump-Pence 2020 Reelection Campaign’s mobile application portfolio on Apple iOS and Google Android smartphones.”

We see PHUN as a better risk-reward opportunity for our subscribers.

Bottom Line

All of the 3 NASDAQ stocks discussed today have already shown explosive moves. We look for NASDAQ stocks that have yet to make their explosive move. There are plenty of opportunities, and we take our time to monitor hundreds of penny stocks to buy each week, trying to find the best alerts for our subscribers.

We run screens every morning looking for news on low float runners that can squeeze the shorts. Our alerts come at the opening bell allowing everyone to participate equally. This is why it’s so important to be signed up for BOTH email and SMS alerts. Alerts can be time-sensitive and you don’t want to miss the next hot runner.

Remember, it’s all about consistency. Our track record speaks for itself. For years, we have provided a FREE service to tens of thousands of traders.

As always, good luck to all (except the shorts)!

WHEN VIRAL STOCKS HAVE A STOCK ALERT, IT CAN PAY TO LISTEN. AFTER ALL, OUR FREE NEWSLETTER HAS FOUND MANY TRIPLE-DIGIT WINNERS FOR OUR SUBSCRIBERS. WE SPECIALIZE IN FINDING MOMENTUM BEFORE IT HAPPENS!

Disclosure: We have no position in any of the securities mentioned. We wrote this article ourselves and it expresses our own opinions. We are not receiving compensation for it. We have no business relationship with any company whose stock is mentioned in this article. Viral Stocks is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This article is not a solicitation or recommendation to buy, sell, or hold securities. This article is meant for informational and educational purposes only and does not provide investment advice.

Image by David Mark from Pixabay