With the end of the trading week it’s time to look at the best stocks with new highs. In this article we will talk about Global Blood Therapeutics, Inc. (NASDAQ: GBT), Sensus Healthcare, Inc. (NASDAQ: SRTS) and Kingsway Financial Services Inc.(NYSE: KFS).

All of which has hit new highs this week due to different catalysts. The reasons why these stocks are running up may differ however they are all showing potential for going even higher in the near future. If you missed their first runs, sign up for our free alerts and never miss another run!

#1 BEST STOCKS WITH NEW HIGHS: GBT

Global Blood Therapeutics, Inc. (NASDAQ: GBT) witnessed over 100% increase over the past week with 33% just on Friday thanks to acquisition talks with Pfizer. GBT is a biopharmaceutical company that works on discovering, developing and commercializing treatments for underserved patient communities with sickle cell disease (SCD).

The company is becoming one of the best stocks to buy at the moment due to an interest from Pfizer. Just this Friday The Wall Street Journal reported that the leading pharma company, Pfizer, is in advanced talks to acquire GBT for almost $5 Billion.

After the release of its vaccine for Covid-19, Pfizer has a lot of cash and is currently working on expanding through acquisitions. Accordingly, a buyout of Global Blood from Pfizer seems like a real possibility. Keeping in mind that both companies still didn’t release any official statements.

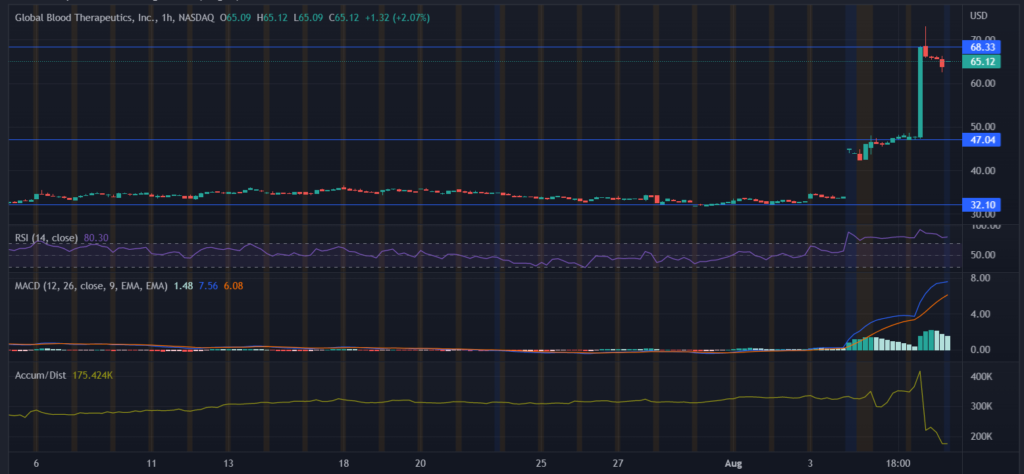

GBT is currently trading at a new high of $65.12 with a resistance at 68.33 and a primary support around 46.29. As well as a stronger secondary support near 32.10.

MACD is on a bullish crossover and showing no signs of another crossover anytime soon. Meanwhile accumulation is trending downwards and the RSI is standing at 80, indicating that GBT stock is overbought at the moment.

With the stock trading far from its support, this might not be the best entry point. However with any official news from GBT or Pfizer, the stock might see a higher run to trade at an all time high.

#2 BEST STOCKS WITH NEW HIGHS: SRTS

As a medical device manufacturer, Sensus Healthcare, Inc. (NASDAQ: SRTS) focuses on developing and selling radiation therapy devices to healthcare providers all over the world. The company has been making headlines quite often in the past few weeks. But what caughts investors’ attention the most was the financial results of the last quarter.

On August 4, Sensus announced the financial results of Q2 2022. Which showed a 124% increase in revues reaching $12.1 million and a net income of $43.5 million – keeping in mind that up until last year the company was operating at a net loss.

It is also worth noting that Sensus ended the quarter with $33.7 cash on hand and Adjusted EBITDA of $4.7 million. With all that in mind, the company is promising continuous growth in this quarter and an overall profitable year.

Following a 30% increase, SRTS is currently valued at an all time high of $14.53 with a primary support near 10.98 as well as a secondary one around 8.74. Sign up now for our 100% free alerts to learn about the hottest NASDAQ and NYSE hottest penny stocks before anyone else!

Accumulation is drastically increasing and the MACD is on a bullish crossover. Meanwhile the RSI is at 81, meaning that the stock is overbought right now. This run up may be short lived, so short term investors might stay holding the bag. However the company is showing tremendous growth potential moving forward, so if you are looking for a long term investment, SRTS might be just right for you.

#3 BEST STOCKS WITH NEW HIGHS: KFS

Last but definitely not least is Kingsway Financial Services Inc.(NYSE: KFS) who hit new highs this week following the announcement of its Q2 financial reports and a $51.2 million sale. Kingsway is a holding company operating through its subsidiaries in various industries including real estate, asset management and business services.

Recently, the company announced the sale of its subsidiary – Professional Warranty Service Corporation (PWSC) for $51.2 million. PCF Insurance Services of the West, LLC – the buyer – already paid KFS $37.2 million in cash. In addition, under the terms of the sale, is entitled to earn additional consideration based upon a one year earnout.

Commenting on that sale, Kingsway’s CEO and President – John T. Fitzgerald – said that

It is a validation of our strategy of backing talented young managers in acquisitions of great businesses and one we hope to continue to replicate within our Search Xcelerator segment. The sale also freed up capital to improve our balance sheet and make new investments. The sale of PWSC, combined with distributions received from PWSC over the years, represents an approximate 10x return on our initial investment of $5 million over roughly 4.5 years

Back to the other major catalyst, the Q2 2022 financial reports shows that the company paid back $3.6 million to settle some of its debts and a significant increase in the non-GAAP adjusted income. Although the company is operating at a net loss of $2.4 million, Cash provided by operating activities improved by $17.7 million to $6.2 million for Q1 and Q2 2022.

Upon the news of the sale and the financial reports, KFS went on a 15,9% run up to be currently traded at $7.29 with a primary support around 5,95 and a secondary one near 5.12.

Although MACD is on a bullish crossover, accumulation is on a downwards trend. Lastly, the RSI is at 82 indicating that the stock is extremely overbought at the moment.

Bottom Line

GBT, SRTS and KFS are all trading at new highs this week, so it might not be a good time to chase. But considering that they all have upcoming catalysts, they definitely should be on your watch list in the next quarter. In the end, it’s good to know that the best stocks may not always be the top gainers of the day, you have to look for companies who are trying and succeeding in giving the best value for their shareholders.

As always, good luck to all (except the shorts)!

WHEN VIRAL STOCKS HAS A STOCK ALERT, IT CAN PAY TO LISTEN. AFTER ALL, OUR FREE NEWSLETTER HAS FOUND MANY TRIPLE-DIGIT WINNERS FOR OUR SUBSCRIBERS. WE SPECIALIZE IN FINDING MOMENTUM BEFORE IT HAPPENS!

Disclosure: We have no business relationship with any company whose stock is mentioned in this video. Viral Stocks is not an investment advisor and this video does not provide investment advice. Always do your own research, make your own investment decisions, or consult with your nearest financial advisor. This video is not a solicitation or recommendation to buy, sell, or hold securities. This video is our opinion and is meant for informational and educational purposes only and does not provide investment advice. Past performance is not indicative of future performance.