With major gains over the last 24 hours, Amylyx Pharmaceuticals, Inc. (NASDAQ: AMLX), Eyenovia, Inc. (NASDAQ: EYEN) & Terns Pharmaceuticals, Inc. (NASDAQ: TERN) are dominating the top gainers’ list and are quickly climbing up investors’ top tech stocks to watch this week! Missed out on these bull runs? Make sure to never miss another with our 100% FREE real-time alerts!

Tech Stocks #1: AMLX

You might be wondering why Amylyx Pharmaceuticals, Inc. (NASDAQ: AMLX) is on fire today. The company – most known for its commitment to supporting & creating more moments for the neurodegenerative community through the discovery and development of innovative new treatments – has been on investors’ radar ever since its latest announcement.

On 8th of September, the company announced that the FDA advisory committee voted that available evidence of effectiveness is sufficient to support approval of AMX0035 (sodium phenylbutyrate and taurursodiol for the treatment of amyotrophic lateral sclerosis (ALS).

If approved, the treatment could present a major breakthrough for the company. Head of Scientific Communications – Jamie Timmons – is bullish given that “the trial data has consistently demonstrated potential benefits of AMX0035 on function and overall survival.”

Following this announcement, the stock spiked to see new heights, and investors believe this is only the start of something huge for this promising company. The effects of this announcement are seen in more than just the massive increase in the stock’s price.

Moving forward, the company assured investors it will remain laser-focused on its mission of ensuring that people living with ALS around the world can access promising new therapies as quickly and efficiently as possible.

After jumping off its support, AMLX is now trading at new highs of $30.3 near its newly formed resistance of 31.02. Accumulation has dropped significantly after being relatively stable for the past few weeks. Meanwhile, the MACD is bullish to the upside and the RSI is fluctuating near 75.

Despite accumulation dropping significantly, the RSI still indicates that the stock is overbought. This, along with a bullish MACD, could indicate investors are bullish the stock could see another run-up past its resistance very soon and have been averaging up on their investment for this reason.

Tech Stocks #2: EYEN

As a clinical-stage ophthalmic company, Eyenovia, Inc. (NASDAQ: EYEN) is well-known for developing a pipeline of advanced therapeutics based on its proprietary microdose array print platform technology. EYEN has been on investors’ radar ever since it released its Q2 financials last month.

The company ended Q2 2022 with nearly $29.4 million in total cash and cash equivalents – including $7.9 million of restricted cash. Despite a high cash flow, EYEN also saw a massive increase in its R&D as well as operational expenses – both of which are largely attributed to the company’s expansion and development efforts.

Chairman of EYEN’s BOD – Dr. Sean Ianchulev – is excited about the company’s “significant progress during the second quarter and subsequent period across both Mydcombi and MicroLine programs. He also highlighted how fortunate the company is to have appointed Michael Rowe as CEO. Lanchulev believes Rowe is the “ideal candidate to sustain EYEN’s current momentum as he will maintain the continuity while bringing significant ophthalmic operations and commercialization expertise to the role ahead of significant regulatory and clinical milestones.”

In light of its growth efforts, the company recently announced it will be present R.W. Baird Global Healthcare Conference. This could be a great step toward the company’s ultimate growth plan and could establish its credibility and would allow more investors to get insight on EYEN’s strategy moving forward.

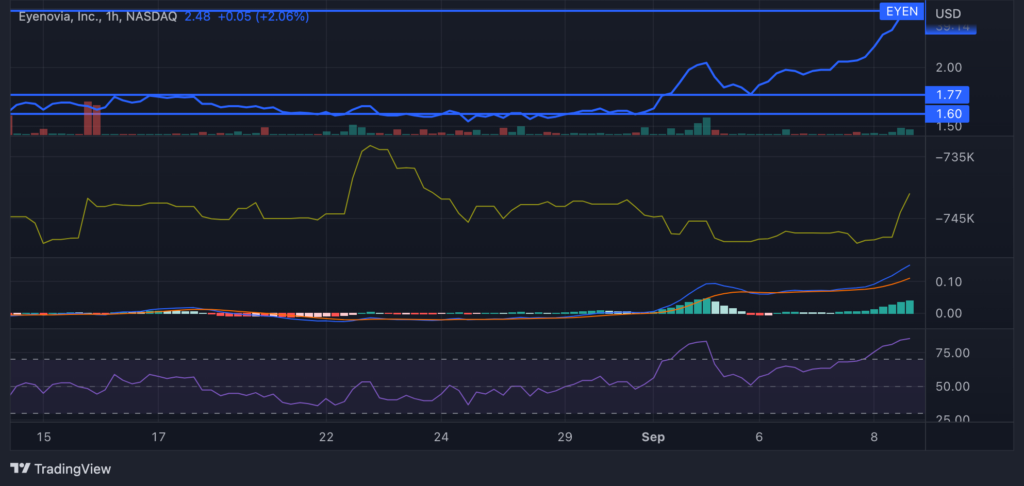

Following its recent run-up, EYEN is trading near its new resistance at $2.48 with support near 1.77 and another at 1.6. Accumulation is seeing a recent uptick after fluctuating over the past couple of weeks. The MACD is bullish to the upside and the RSI is on an upward trend – indicating the stock is extremely overbought.

Tech Stocks #3: TERN

Terns Pharmaceuticals, Inc. (NASDAQ: TERN) is a clinical-stage biopharma company developing a portfolio of small-molecule product candidates to address serious diseases, including oncology, obesity and non-alcoholic steatohepatitis (NASH). As of now, TERN’s pipeline includes four clinical-stage development programs & the company’s always working on expanding & strengthening its product pipeline.

Investors have been watching this company closely ever since the beginning of August. A noticeable increase in institutional ownership has left many bullish on the company’s mission & plans moving forward. Right now, insiders own around 1% of the company in their own names – with shares worth no more than $1.4m in this $173m company.

Recently, TERN announced that it will be presenting at the H.C. Wainwright 24th Annual Global Investment Conference on September 14th. Now that the stock is surging and its market cap saw a $112 million jump, TERN is shaping up to be a promising tech play after all.

Currently trading at $4.96, TERN has formed a recent immediate resistance at 5.04. The stock also shows support at 4.17 and another at 4. Accumulation has dropped significantly after fluctuating for the past few weeks. The MACD is bullish to the upside and the RSI is near 80 but is on a downtrend recently.

Accumulation is on a downtrend following the stock’s recent run-up as investors cash out for profits. However, the MACD & high RSI highlight investors’ overarching bullish sentiment on the stock. With this in mind, TERN could see new heights to break its resistance as its catalysts play out.

BOTTOM LINE

WIth multiple upcoming catalysts, solid management & strong product pipelines, these 3 stocks could see other run-ups to break their current resistance VERY soon. We’re watching them closely & sending out alerts on the best entry points. Get alerts on these & other lucrative tech penny stocks & invest before major run-ups.

As always, good luck to all (except the shorts)!

WHEN VIRAL STOCKS HAS A STOCK ALERT, IT CAN PAY TO LISTEN. AFTER ALL, OUR FREE NEWSLETTER HAS FOUND MANY TRIPLE-DIGIT WINNERS FOR OUR SUBSCRIBERS. WE SPECIALIZE IN FINDING MOMENTUM BEFORE IT HAPPENS!

Disclosure: We have no business relationship with any company whose stock is mentioned in this article. Viral Stocks is not an investment advisor and this article does not provide investment advice. Always do your own research, make your own investment decisions, or consult with your nearest financial advisor. This article is not a solicitation or recommendation to buy, sell, or hold securities. This article is our opinion and is meant for informational and educational purposes only and does not provide investment advice. Past performance is not indicative of future performance.