The market this year has been very hard to predict, one day it’s all green the next it’s all red. Accordingly, finding the right stocks to trade is getting harder each day. However there are always some expectations in the form of stocks rising based on concerte catalysts. Today SAI.TECH Global Corporation NASDAQ: SAI), BBQ Holdings, Inc.(NASDAQ:BBQ) and Atara Biotherapeutics, Inc. (Nasdaq: ATRA) made the list and are proving to be a gloom in the blooming market. Want to get the scoop on the hottest NASDAQ and NYSE penny stocks before anyone else? Subscribe to our 100% free alerts!

#1 STOCKS RISING : SAI

SAI.TECH Global Corporation (NASDAQ: SAI) is a globally renowned clean-tech Bitcoin mining operator. That works on integrating the Bitcoin mining, power, and heating industries. The company is making headlines today for starting to operate in the state of Ohio.

SAI announced that it is beginning to work on its first computing power and heating project in Chesterland, Ohio. Established under the name of SAI NODE across 30,000 square feet, the new facility is planned to be a hub for traditional data center companies and operations in the North America area.

It is also worth noting that SAI NODE is strategically located in close proximity to Canada. Which is becoming one of the fastest growing Bitcoin mining industries in the global hash rate market. The facility is expected to start stocking parts and miners by this month. In order to support and accelerate the company’s expansion plans in the North American region. With all that in mind, SAI believes that this is a major step in their growth plans.

Following the exciting news, SAI stock witnessed a 24% increase in its value and is currently trading at $6.78 with a newly formed resistance around 8.40 and a support near 3.63.

Meanwhile, RSI is standing at 54 and the MACD is on a bullish crossover. However, accumulation is on a downward trend. When the facility starts operating, SAI stock breaks its current resistance and trade at its 52-week high of $12.6 or even higher. That being the case, this might be a good entry point for bullish investors.

#2 STOCKS RISING : BBQ

As a global restaurant company BBQ Holdings, Inc. (NASDAQ:BBQ) engages in franchising and operating casual and fast casual dining restaurants. The company currently has a number of brands with more than 100 company-owned locations and more than 200 franchised locations in the US, Canada and United Arab Emirates.

Just this morning, BBQ announced its entrance into a definitive merger agreement with MTY Food Group Inc. (TSX:MTY). Under the terms of the agreement, MTY will acquire all of BBQ’s issued and outstanding shares for the price of $17.25 per share. The total transaction will reach approximately $200 million.

BBQ will become a subsidiary of MTY upon completion of the Transaction, and its shares will be delisted from the NASDAQ market. Commenting on the new merger, BBQ’s CEO – Jeff Crivello – said

Over the past four years we have significantly grown revenue and our restaurant portfolio while building a world-class team of entrepreneurs. We look forward to continuing the execution of our three pillars of growth, which we believe align very closely with MTY’s vision. With more than 80 brands, MTY brings vast buying power and a team of industry leaders who will provide additional support to our franchise partners.

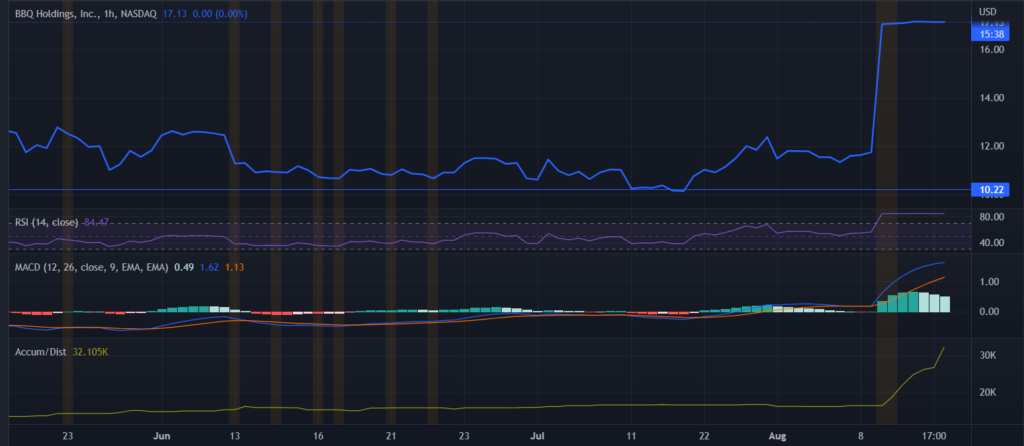

With a 45.95% increase, BBQ is currently trading at $17.13 with a strong support near 10.22. Did you miss this run? Sign up for our free alerts and never miss another run up!

Accumulation is drastically increasing and the MACD is on a bullish crossover. On the other hand RSI is at 84 which indicates that the stock is extremely overbought at the moment. With BBQ Stock trading far from its support, this might not be a good entry.

#3 STOCKS RISING : ATRA

Last but surely not least is Atara Biotherapeutics, Inc. (Nasdaq: ATRA). The company is a T-cell immunotherapy pioneer that uses its novel allogeneic EBV T-cell platform to develop transformative therapies. In order to treat patients suffering from serious diseases such as solid tumors, hematologic cancers, and autoimmune disease.

Recently, Atara announced its plans for focusing on R&D while simultaneously reducing cash burn by more than 20%. The company is also working on a number of clinical trials on their treatments and regulatory filings in the US and the EU. In addition, Atara expects to obtain IND filing for a potential best-in-class allogeneic CD19 CAR T by Q4 2022.

Investors are also bullish on the potential of the company due to the recent release of last quarter’s financial reports. That clearly shows an increase in cash on hand which reached $331.3 million – compared to Q1 2022 $301.8 million. More importantly, Atara now operates with a net income of $18.5 million, or $0.18 per share. Which is a huge improvement from the net loss of $83.8 million in Q2 2021.

Upon the release of the PR statement, ATRA stock increased 30% and is now trading at $4.65 with a primary support around 3.59 and a secondary one near 2.86.

Accumulation is steadily increasing and the MACD is on a recent bullish crossover. Whereas RSI is at 77, indicating that the stock is currently overbought.

BOTTOM LINE

Ask yourself what’s common between SAI, BBQ and ATRA. The answer is quite simple, they all have catalysts that are helping them move forward. When trading any stock don’t just look for high gains, if there’s no real reason why the stock is moving up then eventually it will drop.

As always, good luck to all (except the shorts)!

WHEN VIRAL STOCKS HAS A STOCK ALERT, IT CAN PAY TO LISTEN. AFTER ALL, OUR FREE NEWSLETTER HAS FOUND MANY TRIPLE-DIGIT WINNERS FOR OUR SUBSCRIBERS. WE SPECIALIZE IN FINDING MOMENTUM BEFORE IT HAPPENS!

Disclosure: We have no business relationship with any company whose stock is mentioned in this article. Viral Stocks is not an investment advisor and this article does not provide investment advice. Always do your own research, make your own investment decisions, or consult with your nearest financial advisor. This article is not a solicitation or recommendation to buy, sell, or hold securities. This article is our opinion and is meant for informational and educational purposes only and does not provide investment advice. Past performance is not indicative of future performance.