IPOs, Bitcoin, and new agreements are all great examples of catalysts that can make any stock pop. In this article, we’re bringing you some hot penny stocks with these exact catalysts – Intelligent Living Application Group Inc. (Nasdaq: ILAG), Applied Blockchain, Inc. (NASDAQ: APLD), and Sidus Space, Inc. (NASDAQ: SIDU).

Keep on reading to learn why these stocks can make you tons of money and sign up for our free alerts to get more hot penny stocks!

Promising Penny Stocks #1: ILAG

An initial public offering is the first step towards success but in Intelligent Living Application Group Inc. (Nasdaq: ILAG)’s case the IPO it’s much more than that! The company is quickly catching investors’ interest with the closing of offering of 5,060,000 ordinary shares at a PPS of $4 .

As a premium lockset manufacturer based in Hong Kong, ILAG specializes in manufacturing and selling high quality mechanical locksets. For the past 40 years the company has had customers in many countries however nowadays most of its customers are based in the US and Canada.

On July 13 ILAG stock began trading in the NASDAQ market with the aggregate gross proceeds from the OPO reaching more than $20.24 million. Be the first to learn about the hottest penny stocks in the market by signing up for our free alerts.

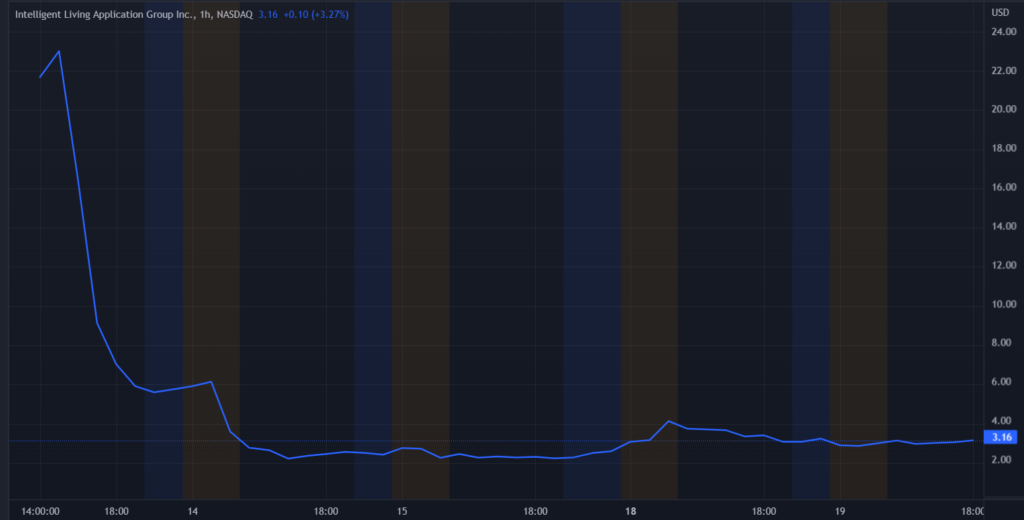

It might be too early to get a good glimpse of how the stock will perform on a technical basis but let’s take a look at how it’s doing so far. ILAG started trading at $21 since then it cooled down to now be traded at $3.16.

Accumulation is on a downwards trend meanwhile the RSI is at 32 but it is gradually increasing. The indicators might seem alarming but at this stage with the stock being traded for only one week that’s completely normal.

Promising Penny Stocks #2: APLD

Although the crypto craze has slowed down a little, Bitcoin-related stocks are still some of the hottest penny stocks in the market. With that in mind, let’s discuss Applied Blockchain, Inc. (Nasdaq: APLD) new hosting contract with one of the largest Bitcoin miners – Marathon Digital Holdings, Inc. (Nasdaq: MARA).

Applied is a builder and operator of next-generation data centers in numerous countries all around North America. The company works on providing vital compute power to blockchain infrastructure and it also supports Bitcoin mining.

Recently, APLD announced its entrance into a five-year hosting contract with MARA to provide comprehensive hosting services for MARA’S Bitcoin miners at Applied Blockchains. This news resulted in over an 80% increase in the stock value today.

Commenting on that, Applied’s CEO said

The multi-year agreement validates our capabilities as a best-in-class co-hosting datacenter operator. We are continuing to grow our contracted hosting capacity, which provides predictable revenue over a multi-year time frame.

Following the 80% run up, APLD is currently trading at $1.86 which serves as its new resistance point. The stock has a primary support around 1.05 and a second one near .88.

Accumulation has been drastically increasing and MACD is on a recent bullish crossover. While the RSI is at 77 indicating that the stock is overbought at the moment.

This might not be a good entry point however with more news on the new contract the stock might reach new highs and eventually be traded at its 52-week high of $34. Missed this run-up? Sign up for our 100% free alerts and never miss another one!

#3 Penny Stocks To Capitalize On: SIDU

Sidus Space, Inc. (NASDAQ:SIDU) is making headlines today for its stock price increasing 32% as a result of the company announcing its growing business relationship with Teledyne Marine.

Sidus is a space-as-a-service satellite company that works on offering a wide array of space-related solutions such as design engineering, statelettie, and hardware manufacturing. As well as data analytics, satellite constellation management, and launch and support services.

Whereas, Teledyne Marine is a group of cutting-edge subsea technology companies working on providing its customers with complete solutions including instruments, seismic, imaging, vehicle, and interconnect technologies. It is also worth noting that the company is a part of Teledyne Technologies, Inc. (NYSE:TDY).

The companies have been collaborating together for the past four years. Just this morning SIDU announced that after both companies reported significant results in Q2 2022, they agreed upon Sidus continuing to supply components to Teledyne Marine’s facilities in the states of Texas and Florida.

But more importantly, they expanded the master supply agreement to also include Sidus supplying components to the facility in Massachusetts.

$SIDU give us that spike up!! https://t.co/zOuEttBZVY

— Donnie Stocks (@DonnieStocks) July 19, 2022

@DonnieStocks is understandably bullish on the potential of SIDU and so are we!

Upon the news, SIDU stock witnessed over a 32% increase in its value to be currently traded at $3.94. The stock has a newly formed resistance at 4.04 and primary support near 3.06 and a second one near 2.8.

Accumulation is on a notable upwards trend and the MACD is on a bullish crossover. RSI is at 71 indicating the stock is overbought right now.

Bottom Line

Overall, securing positions on these 3 penny stocks right now may prove beneficial in the short term. But with their high potential, you can make much much more money if you get in on the next dip and hold on to your stocks as catalysts play out.

As always, good luck to all (except the shorts)!

WHEN VIRAL STOCKS HAS A STOCK ALERT, IT CAN PAY TO LISTEN. AFTER ALL, OUR FREE NEWSLETTER HAS FOUND MANY TRIPLE-DIGIT WINNERS FOR OUR SUBSCRIBERS. WE SPECIALIZE IN FINDING MOMENTUM BEFORE IT HAPPENS!

Disclosure: We have no business relationship with any company whose stock is mentioned in this video. Viral Stocks is not an investment advisor and this video does not provide investment advice. Always do your own research, make your own investment decisions, or consult with your nearest financial advisor. This video is not a solicitation or recommendation to buy, sell, or hold securities. This video is our opinion and is meant for informational and educational purposes only and does not provide investment advice. Past performance is not indicative of future performance.