Revlon Inc.(NYSE: REV), Mereo BioPharma Group plc (NASDAQ: MREO), and Comera Life Sciences Holdings Inc (NASDAQ: CMRA) were among the most active stocks last week. Having been on a recent run-up, these stocks are on investors’ watchlists as bear markets continue to loom. In this article, we analyze each stock’s major catalysts and their potential moving forward.

Revlon Inc. (NYSE: REV)

On June 17th, Revlon Inc. (NYSE: REV) saw a 91% spike upon announcing its filing of voluntary petitions for capital restructuring under Chapter 11 in the US Bankruptcy Court for the Southern District of NY. Debra Perelman – Revlon’s President and CEO – has previously stated that “the company’s challenging capital structure has limited its ability to navigate macro-economic issues in order to meet its growing demand.”

Perelman believes that “by addressing these complex legacy debt constraints, REV will be able to simplify its capital structure and significantly reduce its debt” and in turn, provide a clearer path for its future growth. The president has assured investors that the reorganization will be “as seamless as possible” for the company’s key stakeholders and that it will enable the company to reorganize its legacy capital structure and improve its long-term outlook.

Upon approval, the company expects to receive $575 million in debtor-in-possession (DIP) financing from its existing lender base. By utilizing this funding, REV could easily overcome the current macro-economic challenges, and consequently, better its sales & customer experience. Aside from this, the liquidity could help support the company’s future expansion as well as its existing working capital facility and day-to-day operations.

Given REV’s long-standing reputation as a beauty trendsetter in the color cosmetics and hair care industry, investors are bullish that the liquidity could facilitate major growth for the company moving forward. As of June 21st, REV is trading at $6.33 with resistance near 7.96 and support at 4.05 and 1.12. Its MACD is bullish to the upside and the RSI is at 58.02 indicating the stock is slightly overbought. Meanwhile, accumulation has taken a dip as investors cash out for profits following REV’s recent run-up.

Mereo BioPharma Group plc (NASDAQ: MREO)

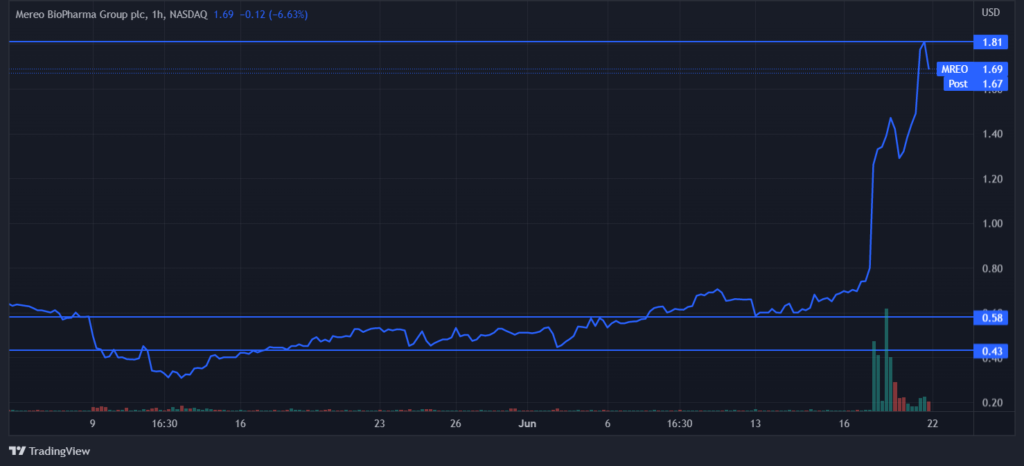

Following a 62.5% increase on June 17th, Mereo BioPharma Group plc (NASDAQ: MREO) became one of the most active stocks of the week. This major run was stimulated upon the issuance of a Times’ report discussing the possibility of a buyout from a globally renowned pharmaceutical and biotechnology company – AstraZeneca. Investors believe that the acquisition will be valued at a PPS of $5 – resulting in a total purchase price of almost $500 million.

This news comes as no surprise given that the two companies have been in business before. In fact, MREO had previously obtained a global license for a rare disease product discovered by AstraZeneca – alvelestat – which MREO is already conducting medical studies on. Given the company’s growth potential, investors believe that if AstraZeneca were to confirm this buyout offer, then it may face stiff competition from Mereo’s other partners who may also be interested in making an acquisition offer, including companies like Ultragenyx Pharmaceutical RARE and OncXerna.

Even though MREO was previously notified by the NASDAQ that it might be delisted for trading under $1 over the past 30 days, the possibility of an AstraZeneca acquisition is already looking like a bullish sign for MREO’s shareholders. Despite not confirming the buyout offer, the stock has already seen major momentum and is now trading at $1.69 with primary support at .58 and secondary support at .43. In fact, this 62.5% spike pushed the stock to its quarter high of $1.81 – which now serves as a new resistance line.

Although accumulation is on a downward trend, the stock’s MACD is on a recent bullish crossover. Similarly, RSI is now at 78 indicating the stock is extremely overbought. With this in mind, investors are bullish that if AstraZeneca finalizes the acquisition, MREO stock could see another run-up to break its resistance and trade at its 52-week high of $3.36.

Comera Life Sciences Holdings, Inc. (NASDAQ: CMRA)

As an emerging life sciences company, Comera Life Sciences Holdings, Inc. (NASDAQ: CMRA) has been making headlines as one of the most active stocks of the week. The stock caught investors’ attention upon the company’s appointment of industry veteran – Michael Campell – as the new Executive Vice President and Chief Financial Officer. With over 30 years of experience in financial leadership, Campbell found success in numerous industries including pharmaceuticals, and has been involved in over 100 strategic alliances and 20 acquisitions across 40 countries.

In light of his expertise, investors are bullish that Campbell could take over the company’s investor relations, treasury, corporate tax, accounting, and reporting. With this in mind, CMRA’s CEO – Jeff Hackman – believes that “this is an exciting time for CMRA with a number of partnerships underway”. Now that the company is equipped with the right personnel, CMRA could be well-positioned to “help maximize the true potential of life-changing biologics” and, in turn, deliver value to all shareholders.

As news of Campell’s appointment broke out, CMRA saw a major increase to trade at $4.09 with a newly formed resistance at 4.64 and secondary resistance at 9.17 as well as support near 1.11. The MACD is on a recent bullish crossover and accumulation is on a steady downtrend following the massive run-up. Meanwhile, the RSI is cooling off at 52 after being extremely overbought at 91 a couple of days ago.

Bottom Line

These 3 stocks are clearly showing major growth potential in the near future. Given their recent run-ups, investors remain bullish on the 3 stocks discussed in an extremely bear market. As emerging leaders in their respective industries, these stocks could likely regulate before reaching new highs or breaking their current resistance. However, given these strong upcoming catalysts, REV, MREO, and CMRA could have major upside returns. Sign up here and be the first to know about top NASDAQ & NYSE penny stocks before they even run.