Shares of Moderna (NASDAQ: MRNA) recently spiked over $400, giving the mRNA vaccine maker a market cap of about $200 billion, greater than big pharma behemoth Merck (NYSE: MRK), for a few days. Investors must have bid up the stock anticipating the need for COVID-19 vaccine booster shots. However, that thesis is extremely flawed and it actually appears that MRNA shares are significantly overvalued. Other means of fighting the continually-evolving pandemic will be necessary, like antivirals that are agnostic to viral strain, as well as immunomodulators that target later stage disease.

Another indication MRNA investors hang their hats on is oncology, specifically personalized cancer vaccines (PCV). As will be discussed, this is a worthy effort for Moderna, but PCVs don’t really address the elephant in the room with fighting cancer—the immunosuppressive tumor microenvironment.

Investors would be safer off looking for less expensive alternatives for investments, or ones where investors haven’t already priced in billions upon billions in future cash flows using a technology with a checkered past of having to work around safety issues.

The Flawed Vaccine Thesis

The first reason MRNA’s shares might be overvalued is because the vaccine thesis in COVID-19 is flawed. Vaccine immunity appears to be waning. For now, to patch up the situation, authorities are now weighing the possibility of needing a third COVID-19 vaccine booster shot, except for those who took the J&J (NYSE: JNJ) vaccine. But repeated doses of mRNA COVID-19 vaccines have shown to induce more and more significant side effects, and in past development of Moderna’s mRNA products, they had to pivot away from products using more than one dose due to safety issues. This is why Moderna pivoted into becoming a vaccine company, as opposed to its plans a few years ago whereby it attempted to be an Orphan Disease company (which would use mRNA products and perpetual dosing of mRNA encoding proteins for people who were missing them or had defective versions of them).

There are also companies working on next generation vaccines that are highly promising, almost destined to outperform Moderna’s COVID-19 vaccine. These new vaccines in testing are designed to optimize immunity, target immutable sites on the virus, induce longer term immunity, or even generate memory immunity, such as Vaxart (NASDAQ:VXRT), Gritstone (GRTS), or Generex Biotechnology/NuGenerex Biotechnology (NASDAQ: GNBT). Some of these products are peptide vaccines which can be lyophilized and stored at room temperature and reconstituted with liquid at the time of administration.

Regardless, for now, it also appears that vaccines will forever lag variants of the virus, and even with improved vaccines, the reality of the situation is that immunity may never last forever. Vaccines aren’t the only answer to the pandemic and Moderna’s vaccine could be eclipsed by better products with better efficacy and safety.

Moderna’s Checkered Past: Safety Issues and Strategic Pivoting

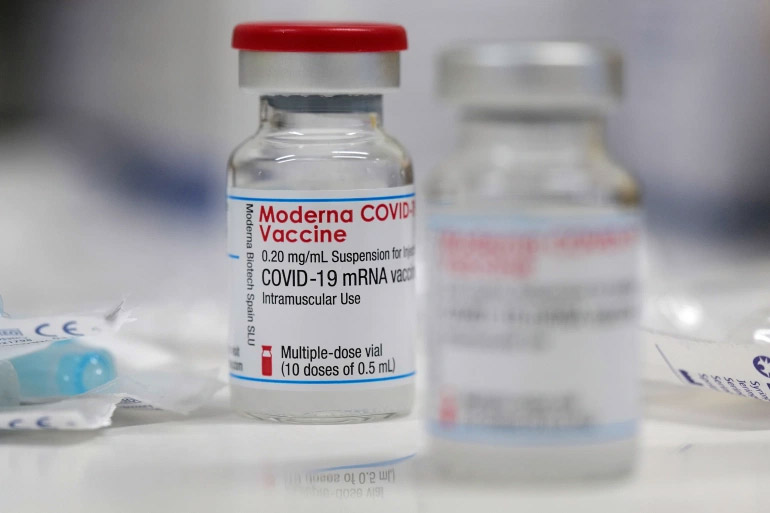

For now, at least, the vaccines that are being used prolifically, specifically Moderna’s, use technology that has had interesting safety hurdles.

Some people don’t know the backstory of why Moderna is a vaccine company. The mRNA platform can be used to deliver to the body the mRNA encoding for virtually any protein—so why not focus on chronic disease whereby people are dosed consistently, and there’s more recurring revenue potential? Well, years ago, Moderna ran into safety issues with their products. Consistent dosing proved to be tolerated more and more poorly as the dosing continued. Will this be an issue with booster shots, or is it only an issue with weekly, biweekly or monthly dosing? An excerpt from another article on Moderna’s technology before it went public or had the COVID vaccine out reminds investors of the issues with mRNA: