IPO Stocks #1: JZ

Today, investors are watching Jianzhi Education Technology Group Co Ltd – ADR (NASDAQ:JZ) closely after the Group filed proposed terms for a $30 million IPO of its American Depositary Shares (ADSs).

Through its digital education content platform, the firm provides professional online education content to businesses and consumers in China. JZ intends to raise $30 million in gross proceeds from the upcoming IPO – offering 5 million ADSs at a PPS of $6. If successful, this IPO will value the company at almost $337 million, excluding the effects of underwriter over-allotment options.

The company is seeking this public market investment to fund its internal growth initiatives. In fact, management has announced its intentions to use 50% of net proceeds from the IPO to develop & produce new educational content as well as purchase educational content from third parties. Meanwhile, other proceeds will be used to develop and produce new educational content in-house or through commissioning as well as research and development expenditures in product development and technology capabilities.

It is important to note that the growth potential behind this stock is uncanny. Previous research shows that the overall Chinese education services market is expected to be worth almost $573 billion by next year – a CAGR of 11.3% since 2018. Get alerts on penny stocks with MAJOR potential like this one in your inbox!

Given the company’s initiatives & the increasing demand for online courses, this trend is expected to grow. Despite the fact that JZ now faces fierce competition from other brands in this lucrative market, the company has shown steady financial performance over the last few quarters – reporting growth in topline revenue & an increase in operating cash flow.

IPO Stocks #2: MEGL

On August 5th, Hongkong financial services provider Magic Empire Global Limited (NASDAQ: MEGL), announced the pricing of its IPO of 5 million OS at a PPS of $4. The aggregate gross proceeds from the Offering will amount to $20 million – without deducting underwriting discounts & other related expenses.

Only 4 days after it announced the pricing of its IPO, MEGL saw a major decrease of nearly 87% for no solid reason. This extreme volatility has stirred talks among investors as Head of wealth management at Saxo Capital Markets Ken Shih commented: “At this point, downside risk for investors clearly outweighs upside.”

MEGL announced the closing of its IPO on August 10th – 1 day after its price plummeted. Even though it traded nearly 25% higher in pre-market, the wild trading volatility continued and the stock finished the day slightly down.

For this reason, an increasing number of investors are now realizing the risk that comes with this low float stock. However, this isn’t the first small IPO out of Hong Kong or China that has exploded and then traded with volatility. Bloomberg reported this happening nearly 7 times in 2022 only – so the pattern isn’t surprising.

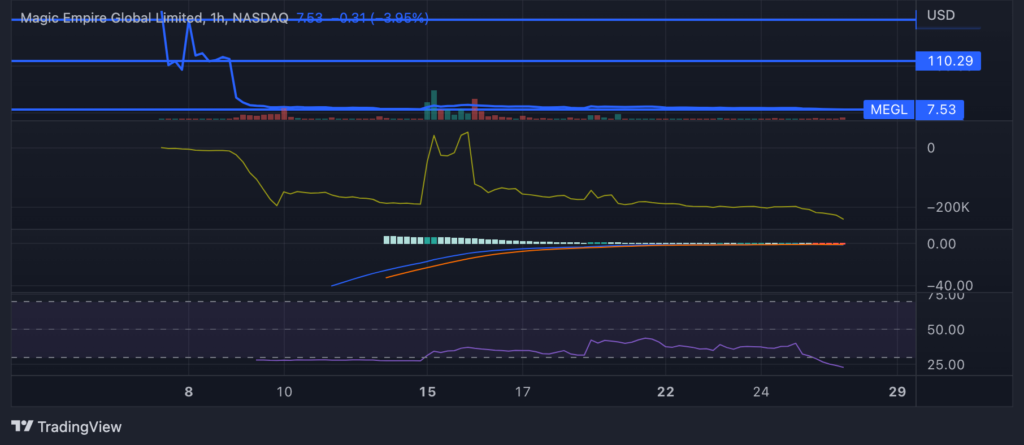

Currently trading near its support of 7.45, MEGL has a PPS of $7.53 after its downfall earlier this month. Given its IPO, the stock shows resistance at 110.29 & another at 197.51. Accumulation has been steady following its steep decline earlier this month and the MACD is bearish but is on the verge of another crossover. The RSI is at 23 but continues to trend downwards – indicating the stock is currently oversold.

IPO Stocks #3: HKD

One of the most comprehensive one-stop digital solutions platforms in Asia, AMTD Digital Inc announced on July 15th the pricing of its initial public offering of 16 million ADSs – five of each represent two of the company’s Class A ordinary shares, at a PPS of $7.8.

From its IPO, the company raised total gross proceeds of $124.8 million – assuming the underwriters of the IPO do not exercise their option to purchase additional ADSs.

Upon the announcement, the stock traded at a whopping 312.5% increase then the IPO price. However, since then the stock has witnessed massive volatility that has affected its trade volume immensely.

After announcing the closing of the IPO, HKD was valued at almost $1.443 billion – representing the second unicorn under AMTD Group Company Limited to be successfully listed on NYSE.

Currently trading at $158.61, HKD has near support at 170 and resistance at 2299. Accumulation has been steady following its run-up earlier this month and the MACD is bullish but is on the verge of a bearish crossover. The RSI is holding at 40 – indicating the stock is slightly oversold.

BOTTOM LINE

Despite their volatility, these IPO Stocks could be promising investments in the long run in light of their growth efforts. Now investors are awaiting JV’s IPO and are skeptical that the pattern will be very similar to that of MEGL & HKD. However, only time will tell. Be the FIRST to know ALL the best penny stocks to invest in!

As always, good luck to all (except the shorts)!

WHEN VIRAL STOCKS HAS A STOCK ALERT, IT CAN PAY TO LISTEN. AFTER ALL, OUR FREE NEWSLETTER HAS FOUND MANY TRIPLE-DIGIT WINNERS FOR OUR SUBSCRIBERS. WE SPECIALIZE IN FINDING MOMENTUM BEFORE IT HAPPENS!

Disclosure: We have been Previously compensated $42,500 by awareness consulting network for coverage on AGRI. Viral Stocks is not an investment advisor and this article does not provide investment advice. Always do your own research, make your own investment decisions, or consult with your nearest financial advisor. This article is not a solicitation or recommendation to buy, sell, or hold securities. This article is our opinion and is meant for informational and educational purposes only and does not provide investment advice. Past performance is not indicative of future