Biotech Penny Stocks #1: INM

Earlier this month, InMed Pharmaceuticals Inc. (NASDAQ: INM) – a leader in the areas of R&D and manufacturing of rare cannabinoids – released an update on its R&D and commercial activities that resulted in a major spike in its PPS.

Right now, INM is focusing its efforts on advancing discovery work for the potential use of a rare cannabinoid & their analogs to improve neuronal function as well as providing neuroprotection for treating several common neurodegenerative disorders.

CEO Eric Adams commented on the company’s progress saying:

This research further reflects our efforts in the fields of dermatology and ocular disease to identify and develop cannabinoids that have significant therapeutic potential in treating disease.”

The company’s CEO also reported that INM “remains enthusiastic about the potential of the proprietary cannabinoid analog program that resulted from the company’s acquisition of BayMedica, LLC (“BayMedica”) in October 2021.”

Despite the significant efforts by the commercial team at BayMedica, the market demand for the BayMedica naturally-occurring cannabinoids in the Health & Wellness sector is not progressing as anticipated. However, Adams has assured investors of the company’s commitment to advancing its “pharmaceutical drug development programs with the aim of achieving important milestones in the coming quarters and years.”

The company is already honoring its promise to investors after announcing the closing of its previously announced private placement with two healthcare-focused institutional investors for the issuance & sale of 691,245 of its common shares at a PPS of $8.68 – with aggregate gross proceeds of nearly $6 million.

INM plans to use the net proceeds from the offering to continue the pipeline development of its pharmaceutical drug candidates, advance manufacturing know-how of cannabinoids and cannabinoid analogs, and support intellectual property development & other commercial activities.

Now trading at $9.5, INM has immediate support at 8.22 and another one it hasn’t broken at .27. INM saw a rapid increase in its PPS and formed resistance at 18.6. Accumulation has been on a stable uptrend ever since the stock’s run-up. However, the MACD is bearish and the RSI is on a downtrend.

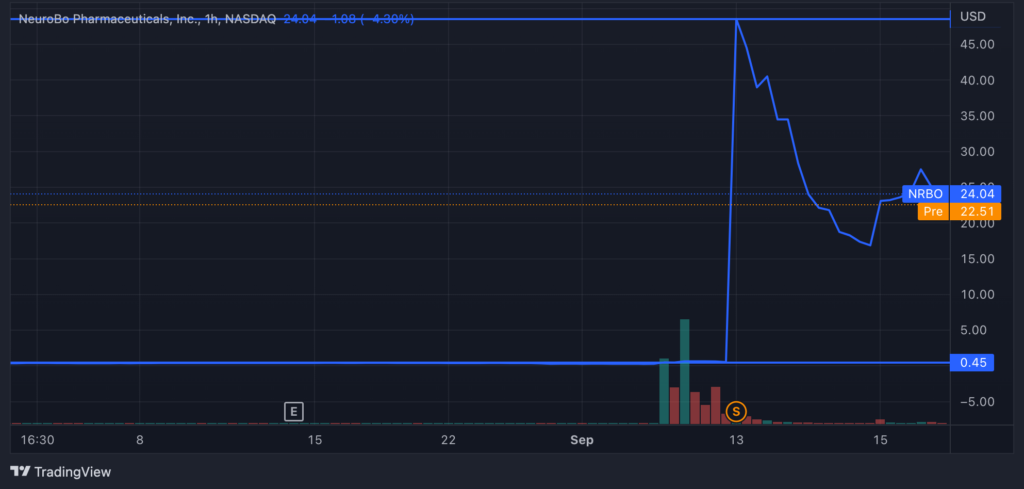

Biotech Penny Stocks #2: NRBO

NRBO has seen a triple-digit increase recently that has attached the attention of many biotech investors. NeuroBo Pharmaceuticals, Inc. (NASDAQ: NRBO), and Dong-A ST Co., Ltd. recently announced that they have entered into an exclusive license agreement for NRBO to develop and commercialize DA-1241 and DA-1726 – currently being evaluated for the treatment of nonalcoholic-steatohepatitis, obesity and type 2 diabetes.

Best known as a clinical-stage biotech company, NRBO has historically focused on therapies for neurodegenerative & infectious diseases. Upon closing of the agreement, the company will expand its focus to include cardiometabolic diseases as well.

President Gil Price is bullish on this step saying: “The acquisition of these two cardiometabolic assets marks a seismic shift for NRBO, providing us with a highly promising, diversified pipeline with several upcoming value inflection points in the NASH and obesity space — areas with enormous market opportunity”.

Min Young Kim – Dong-A’s CEO – is “highly enthusiastic about this opportunity to accelerate the development of its novel treatments in partnership with NRBO.”

With a massive increase in its PPS, NRBO is now trading at 24.04 with new resistance near 45 – jumping off from a strong support at only .45. Accumulation has been steady but is recently declining parallel to the run-up. This could be an indication that investors are cashing out for profits. However, accumulation seems to be stable recently.

Biotech Penny Stocks #3: CMRA

Comera Life Sciences Holdings, Inc. (NASDAQ: CMRA) is a life sciences company known for developing a new generation of bio-innovative biologic medicines to improve patient access, safety, and convenience. Last month, the company announced its entry into a purchase agreement with Arena Business Solutions Global SPC II, Ltd. for up to $15 million of the CMRA’s common stock.

Management is bullish that “strengthening the company’s balance sheet will position it to achieve strategic objectives in the near-term.”

Grateful for Arena’s commitment to CMRA’s success, CEO Jeffrey Hackman commented that “the line of credit provides the opportunity to invest in our pipeline and proprietary formulation platform, SQore™, which is designed to transform intravenous biologics into subcutaneous versions that patients can self-administer in a single dose”.

After jumping off its support, CMRA is now trading at $3.56 near its newly formed resistance of 3.81. Accumulation has been fluctuating ever since the run-up and the MACD is bullish but is on the verge of another crossover. The RSI is at 77 – indicating the stock is currently overbought.

In light of these indicators, bullish investors should wait for CMRA to cool off near its support and for the RSI to indicate is stable to trade before securing positons on this promising biotech play. Wanna know what’s the best entry point on a stock like CMRA? Get alerts for FREE!

BOTTOM LINE

Taking into consideration the growth efforts and upcoming catalysts on these 3 biotech stocks, it’s no surprise they are on investors’ watchlist & the overall sentiment is bullish. With this in mind, these 3 plays could see other run-ups soon after their RSI calms down. We’ll be watching them and many other biotech stocks closely & sending out alerts to our subscribers!

As always, good luck to all (except the shorts)!

WHEN VIRAL STOCKS HAS A STOCK ALERT, IT CAN PAY TO LISTEN. AFTER ALL, OUR FREE NEWSLETTER HAS FOUND MANY TRIPLE-DIGIT WINNERS FOR OUR SUBSCRIBERS. WE SPECIALIZE IN FINDING MOMENTUM BEFORE IT HAPPENS!

Disclosure: We have no business relationship with any company whose stock is mentioned in this article. Viral Stocks is not an investment advisor and this article does not provide investment advice. Always do your own research, make your own investment decisions, or consult with your nearest financial advisor. This article is not a solicitation or recommendation to buy, sell, or hold securities. This article is our opinion and is meant for informational and educational purposes only and does not provide investment advice. Past performance is not indicative of future performance.