For quite a long period now biotech companies stocks have been included in every investor’s portfolio. In fact most days, you will find at least two biotech stocks in the top gainers’ list. In this article we will talk about two biotech stocks running up today and showing promising growth potential in the near future, Karuna Therapeutics, Inc. (NASDAQ: KRTX) and CinCor Pharma, Inc., (NASDAQ: CINC). Don’t have time to find your own stocks? Subscribe to our 100% free hot stocks alerts now and we will do all the work for you!

Some investors believe that biotech companies stocks are too risky because usually their main catalysts are updates on their drugs and clinical trials. However there’s no guarantee that these treatments will see the light. With that in mind, it’s easy to see why investors may think it’s quite the risk but all stocks are risky in their own way, at least biotech stocks have science on their side.

#1 BEST BIOTECH COMPANIES STOCKS : KRTX

Karuna Therapeutics, Inc. (NASDAQ: KRTX) is witnessing a major 63.9% run up today, thanks to the positive results of an ongoing study. As a clinical-stage biotechnology company, Karuna specializes in developing and commercializing transformative drugs for people living with psychiatric and neurological conditions.

The company’s primary drug candidate is KarXT, which is being developed for psychiatric and neurological conditions. That includes schizophrenia and psychosis in Alzheimer’s disease. KarXT is the first potential medicine of its kind, with a truly novel and distinct dual mechanism for treating symptoms of serious mental illness. that does not rely on the dopaminergic or serotonergic pathways.

Recently, Karuna released positive results from its Phase 3 EMERGENT-2 trial of KarXT. This phase focused on testing the drug’s efficacy, safety, and tolerability. The trial showed successful results of significant 9.6-point reduction in the Positive and Negative Syndrome Scale (PANSS). It also showed a notable reduction in symptoms and it was overall well tolerated by patients. Commenting on that, Karuna’s CEO and President – Steve Paul, M.D.- said that

We are thrilled that these topline results from the Phase 3 EMERGENT-2 trial confirm what was seen in our Phase 2 EMERGENT-1 trial and underscore the potential for KarXT, with its novel and unique mechanism of action, to redefine what successful treatment looks like for the 21 million people living with schizophrenia worldwide, and potentially usher in the first new class of medicine for these patients in more than 50 years.

He went on to add that the company is planning on submitting for an FDA approval by mid 2023. For the meantime, KRTX will focus its efforts on gathering long term safety data to support its FDA approval.

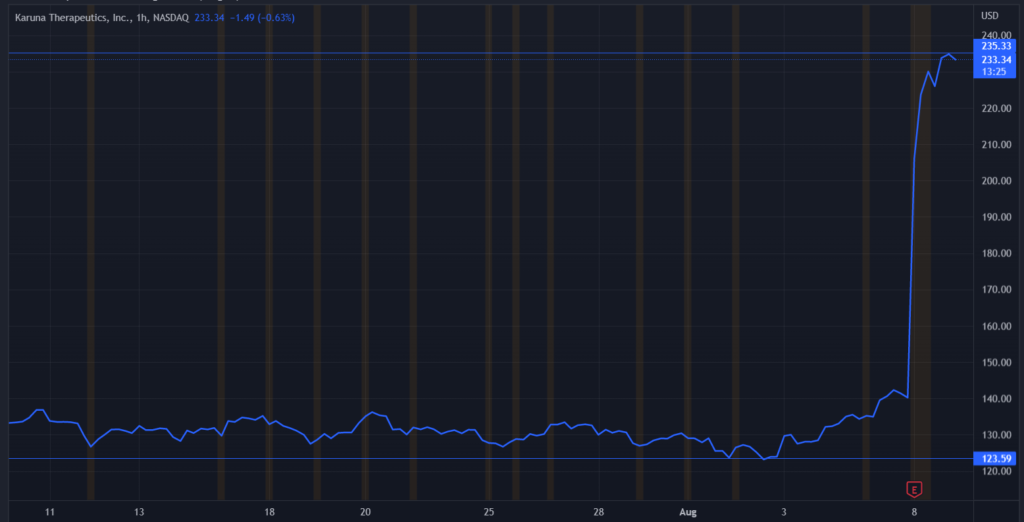

Following the 63.9% run up, KRTX is currently trading at $233.75 with a newly formed resistance around 235.33 and a strong support near 123.59.

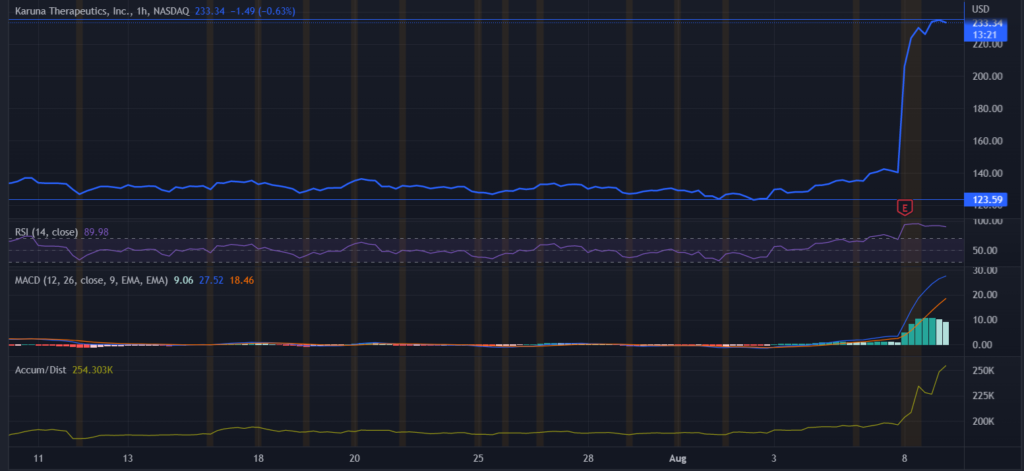

The MACD is on a recent bullish crossover and accumulation is drastically increasing. Meanwhile the RSI is standing at 90, indicating that the stock is extremely overbought at the moment. Couldn’t catch this run? Join our free alerts so you never miss another one!

#2 BEST BIOTECH COMPANIES STOCKS : CINC

CinCor Pharma, Inc. (NASDAQ: CINC) is also a clinical-stage biopharmaceutical company. However it focuses on developing treatments for cardio-renal diseases. The company is on investors’ radar today as it came out with Q2 financial records and some promising results on its Phase 2 BrigHtn trial of baxdrostat – drug developed for the treatment of patients with treatment-resistant hypertension.

The Phase 2 study’s results successfully showed the drug reached its goal of reducing the systolic blood pressure. It also has no safety concerns across three dose levels tested after 12 weeks of treatments.

Additionally, CinCor is currently working on a number of other clinical trials to identify baxdrostat’s safety and efficacy in patients with blood pressure that is not controlled despite ongoing treatment as well as patients with uncontrolled hypertension and chronic kidney disease. The first trial is planned to be finalized by the second half of this year, whereas the second trial is expected to be completed by the second half of 2023.

Besides the clinical trials, CINC is also gaining momentum for the release of last quarter’s financial records. Which clearly shows an increase in cash on hand – currently at $294.3 million compared with Q2 2021 total of $136.6 million. This can be traced back to the company’s IPO in January in which CINC received net proceeds of $193.6 million.

Although the company is currently operating at a net loss and many expenses have increased compared to last year. That’s nothing to worry about with all the studies and clinical trials it’s working on nowadays.

Upon the news CINC went on a major run up and is currently being traded at $34.9 with a resistance at 41.85. The stock has a primary support around 21.51 and a secondary one near 19.71.

MACD is on a bullish crossover with no signs of another crossover any time soon. Whereas accumulation is trending downwards and the RSI is at 69 indicating that CINC is overbought right now.

BOTTOM LINE

Biotech companies stocks should be played for the long run. KRTX, CINC and many other biotech stocks have proven many times that they are reliable and trustworthy. This lucrative sector is definitely worth looking into!

As always, good luck to all (except the shorts)!

WHEN VIRAL STOCKS HAS A STOCK ALERT, IT CAN PAY TO LISTEN. AFTER ALL, OUR FREE NEWSLETTER HAS FOUND MANY TRIPLE-DIGIT WINNERS FOR OUR SUBSCRIBERS. WE SPECIALIZE IN FINDING MOMENTUM BEFORE IT HAPPENS!

Disclosure: We have no business relationship with any company whose stock is mentioned in this article. Viral Stocks is not an investment advisor and this article does not provide investment advice. Always do your own research, make your own investment decisions, or consult with your nearest financial advisor. This article is not a solicitation or recommendation to buy, sell, or hold securities. This article is our opinion and is meant for informational and educational purposes only and does not provide investment advice. Past performance is not indicative of future performance.