With the start of a new trading week, investors are on the lookout for cheap stocks with major potential. A while ago, we alerted Mullen Automotive, Inc. (NASDAQ: MULN) and have been watching it ever since. Today, the stock is once again stirring talks among many investors and continues to dominate the list of top gainers along with Kaspien Holdings Inc. (NASDAQ: KSPN). In this article, we’ll go over the catalysts that made each stock pop today and why investors believe in their potential moving forward.

Cheap Stocks to BUY #1: MULN

The emerging electric vehicle manufacturer has been on our radar ever since it announced a $18 million debt reduction earlier this month. Today, shareholders are seeing the benefit of this step as the company strengthens its financial position within this incredibly lucrative and competitive market.

With its most recent announcement, MULN is once again climbing up investors’ watchlists and continues to be one of the best cheap stocks to buy. On July 11th, MULN signed a binding agreement with DelPack Logistics, LLC – an Amazon Delivery Services Partner – for Class 1 & 2 EV Cargo Vans.

Given that DelPack is a leader in last mile package delivery, David Michery – MULN’s CEO & chairman – believes this agreement is a major milestone for the company and will “put MULN’s class 1 cargo van program front and center for last-mile delivery opportunities.”

Big News📢: Amazon Delivery Services partner DelPack Logistics, LLC to place an order for up to 600 Mullen Class 2 #EVCargoVans over the next 18 months. Learn more — https://t.co/q3UsHpeyfm$MULN #MullenAutomotive #MullenONE #EVs #ElectricCars #DriveElectric pic.twitter.com/cgfIdzGfq0

— Mullen Automotive (@Mullen_USA) July 11, 2022

Under the terms of the agreement, DPL is to place an order for up to 600 Mullen Class 2 Electric Cargo Vans – all of which are fully homologated for the US – over the next 18 months. According to the company’s plans, MULN intends to deliver the first 300 fully homologated Mullen Class 2 EV Cargo Vans to DPL by the end of this November.

MULN shares shot up 16.2% in premarket trading Monday. At the time of this writing, MULN has cooled off from its run-up and is now trading at $1.2 with near support at 1.14 and another at 1. Meanwhile, the stock has resistance at 1.3 and a stronger one at 1.65. Accumulation has been seeing a sharp steady downfall ever since MULN’s previous run-up. Similarly, the RSI is at 53 but is trending downwards and the MACD is approaching a bullish crossover.

Since we alerted MULN, the stock is up more than 20%. Want in on the next BEST penny stock? Sign up here for 100% free alerts!

Cheap Stocks to BUY #2: KSPN

In its latest Q1 2022 fiscal report, the leading e-commerce marketplace growth platform – Kaspien Holdings Inc. (NASDAQ: KSPN) reported major progress in its strategy. The company highlighted progress in its long-term corporate initiatives as well as its ongoing operations in High-Value Opportunities within Retail and Agency Verticals. Not only that, but the company also disclosed renewed contracts with some of its major partners along with a $3 million decline in its operating expenses. Since the release of this report, investors have been bullish on the company’s foundation and many believe it is well-positioned for future revenue growth and profitability.

This progress was the result of so many factors. Commenting on that, Interim CEO Brock Kowalchuk said:

In the first quarter, we took several necessary steps to better align the focus of our organization for long-term stability”

While the company’s transition process could take time, Kowalchuk seems bullish on the progress so far and is excited “to unlock further growth opportunities with existing brand partners as the company continues driving working capital improvements and executing on its updated corporate strategy.”

In light of the company’s long track record of success – having served over 4,000 brands in 20 countries, investors are bullish that KSPN’s mastery of the e-commerce space and its commitment to rapid innovation will be the driving force in building sustainable relations with leading global brands.

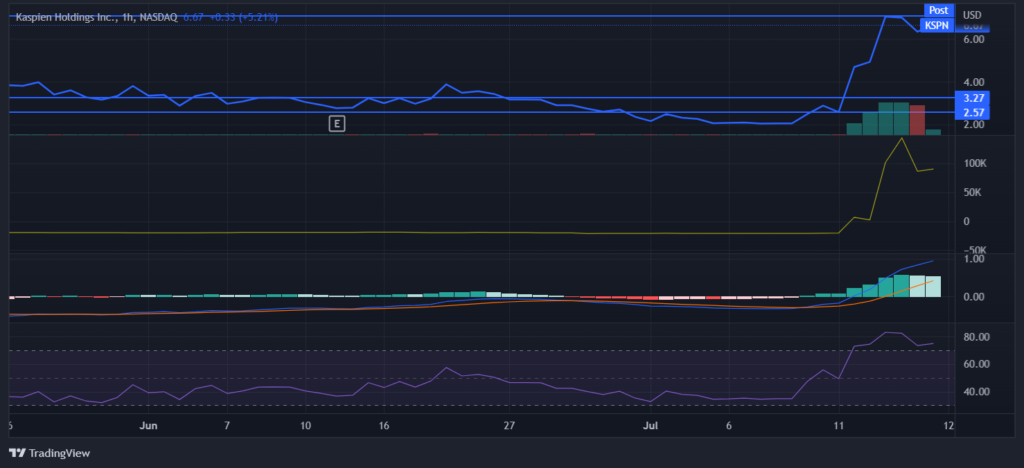

After its major run-up today, KSPN closed near its resistance at $6.67 with strong support at 3.27 and 2.57. Despite being stable for the past couple of weeks, Accumulation has seen a slight decline following its recent steep run-up. Meanwhile, the MACD is on a recent bullish crossover and the RSI continues to trend upwards and is now holding at 79 – indicating the stock is overbought.

These indicators clearly highlight investors’ bullish sentiment. The slight fall in accumulation could likely be the result of investors cashing out for profits following the stock’s massive run-up. However, both the RSI and the MACD affirm investors’ belief in the future of the company in the coming months.

BOTTOM LINE

The partnership MULN announced as well as the financial and strategy progress that KSPN has reported serve as MAJOR catalysts that could push their PPS way beyond their current resistance. As these catalysts play out and as both companies announce further developments, we’ll be watching MULN & KSPN closely and we’ll keep you in the loop all the way..

As always, good luck to all (except the shorts)!

WHEN VIRAL STOCKS HAS A STOCK ALERT, IT CAN PAY TO LISTEN. AFTER ALL, OUR FREE NEWSLETTER HAS FOUND MANY TRIPLE-DIGIT WINNERS FOR OUR SUBSCRIBERS. WE SPECIALIZE IN FINDING MOMENTUM BEFORE IT HAPPENS!

Disclosure: We have no business relationship with any company whose stock is mentioned in this video. Viral Stocks is not an investment advisor and this video does not provide investment advice. Always do your own research, make your own investment decisions, or consult with your nearest financial advisor. This video is not a solicitation or recommendation to buy, sell, or hold securities. This video is our opinion and is meant for informational and educational purposes only and does not provide investment advice. Past performance is not indicative of future performance.