With the stock market on a downward trend, it’s important to know what are the NASDAQ stocks with the highest potential. There are many stocks that can benefit your portfolio in the long run but in these hard times, it’s not really the time for risks. In this article we will review Visionary Education Technology Holdings Group Inc. (Nasdaq: VEDU), Ocean Bio-Chem, Inc. (NASDAQ: OBCI) and Omeros Corporation (Nasdaq: OMER) to learn why investors are quickly piling in.

#1 NASDAQ STOCK TO WATCH: VEDU

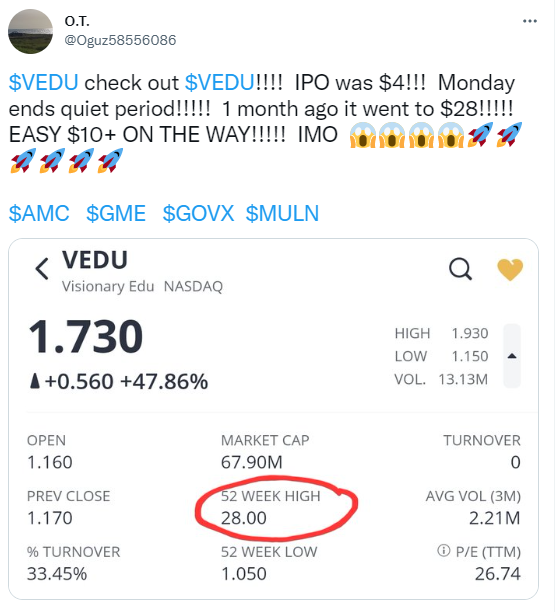

Visionary Education Technology Holdings Group Inc. (Nasdaq:VEDU) is a private education provider that focuses on providing students all around the globe with quality education. On June 23rd the stock went on a notable 32% run up. The run up was short lived, however the stock is still currently trading a lot higher than its usual numbers.

On May 19th, Visionary Education announced the closing of its IPO of 4,250,000 common shares at a price of $4 per common share. Overall, the company received around $17 million in aggregate gross proceeds – not including the underwriting discounts and other expenses.

Although the reason behind the run-up is not clear, the company has a lot going on in its future. Taking into consideration its low float of under 10 million shares and an outstanding share count of less than 42 million, it is highly likely that another run up will happen soon.

On that note, the VEDU stock is currently trading at $1.86 with a newly formed resistance at 2.2 and a primary resistance around 1.15. As well as a secondary one near 1.06.

Although accumulation is trending downwards, MACD is on a recent bullish crossover. Finally the RSI has been fluctuating a lot but it’s now holding at 57. Most of the indicators are showing positive signs which indicates that with any news from the company, the stock might see a rapid increase in its value. The current low price seems like a good entry point for bullish investors as the stock is currently undervalued. Sign up now to get the latest NYSE & NASDAQ Penny Stock alerts!

#2 NASDAQ STOCKS TO WATCH: OBCI

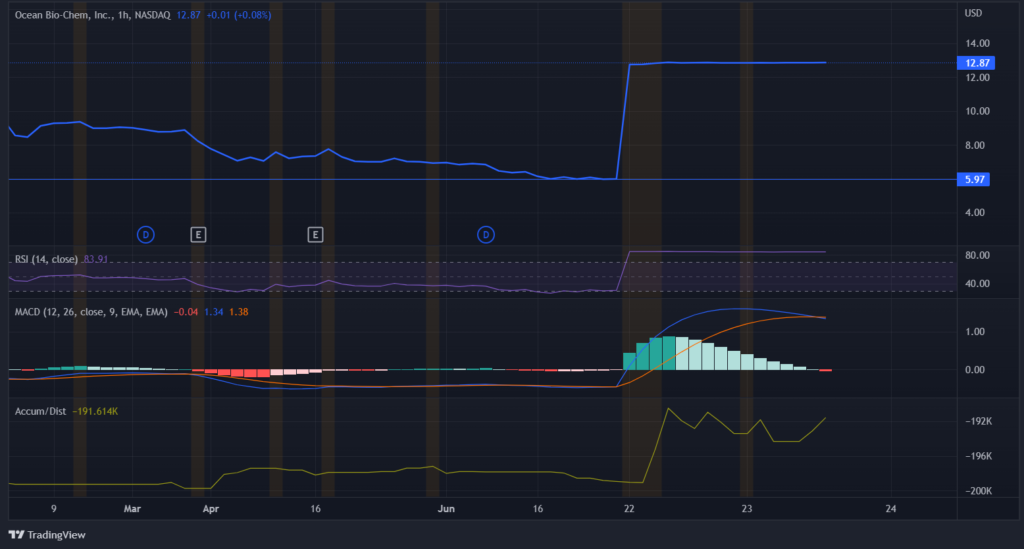

Ocean Bio-Chem, Inc. (NASDAQ: OBCI) has been making headlines this morning for going on a major run up upon signing a definitive agreement with the leading and fastest growing marine retailer – OneWater Marine Inc. (NASDAQ: ONEW). One Water is to acquire OBCI with almost $125 million in all cash transaction at $13.08 per share.

As a premium supplier and distributor of cleaning, maintenance and appearance products for the marine sector, OBCI is expected to be a beneficial contributor to the One Water family. It is also worth mentioning that One Water will also acquire OBCI’s subsidiary – Star Brite Europe, Inc. Both companies will be an active part of One Water’s affiliate – T-H Marine Supplies, LLC – that’s responsible for the strategic growth of parts and accessories businesses. Commenting on that, CEO and President of OBCI – Peter Dornau – said:

With OneWater’s support and resources, we can implement promising new product lines. At the same time, we can also leverage sales relationships across a combined portfolio to continue our histories of profitable growth.

On that note, investors are feeling bullish over the growth potential of the company. After a 114% increase over the past two days, OBCI is currently trading at $12.87 which now serves as its new resistance. The stock has strong support near 5.97 that hasn’t been broken for the past 52 weeks.

Accumulation has been gradually increasing however other indicators are showing some negative signs. For instance, RSI stands at 83 indicating the stock is extremely overbought while the MACD just approached a bearish crossover. However, it could be heading for a reversal soon.

#3 NASDAQ STOCKS TO WATCH: OMER

The Last NASDAQ stock on our watchlist this week is Omeros Corporation (Nasdaq: OMER). The thriving biopharmaceutical company has been gaining momentum for its recent filings with the SEC that shows some insider filing.

As a company that works on discovering, developing, and commercializing therapeutics for small-molecule and protein, Omeros has lost some of its value over the past years with the whole medical industry focusing on the pandemic. However, the company is regaining its rightful place in the market.

On 17th July Omeros hosted its annual shareholder meeting then on the 22nd of July the company filed seven Form 4s with the SEC. Form 4 is filed to show the changes in the holdings of anyone in the company that might have insider information or information yet to be disclosed to the public.

The filings of Omeros present an increase in the stock option for a number of the company’s directors. This might be an indicator that the company is expecting growth, higher revenues, or any other positive catalysts in the near future.

The charts are already showing positive signs with the value of the OMER stock increasing to trade at $2.65 with a newly formed resistance at 2.95 and support near 1.94.

RSI started off the trading day high at 84 but since then it has cooled off at 58. Meanwhile, accumulation has been heavily fluctuating and the MACD is on a recent bearish crossover. These indicators might show the stock losing some of its momoentum. However, positive signs, investors are feeling bullish on the potential of the company moving forward.

Bottom Line

Buying dips and selling rips is a great strategy but the three NASDAQ stocks we discussed today are there for the long run. If you are looking for the next big thing then you are in the right place. VEDU, OBCI and OMER all have the potential for tremendous growth, and with the current prices, it might be a good entry point for bullish investors.

Subscribe now & get the top runners of the day before anyone else!!

As always, good luck to all (except the shorts)

WHEN VIRAL STOCKS HAS A STOCK ALERT, IT CAN PAY TO LISTEN. AFTER ALL, OUR FREE NEWSLETTER HAS FOUND MANY TRIPLE-DIGIT WINNERS FOR OUR SUBSCRIBERS. WE SPECIALIZE IN FINDING MOMENTUM BEFORE IT HAPPENS!

Disclosure: We have no business relationship with any company whose stock is mentioned in this video. Viral Stocks is not an investment advisor and this video does not provide investment advice. Always do your own research, make your own investment decisions, or consult with your nearest financial advisor. This video is not a solicitation or recommendation to buy, sell, or hold securities. This video is our opinion and is meant for informational and educational purposes only and does not provide investment advice. Past performance is not indicative of future performance.