Tech stocks have regained their momentum and been dominating the market for quite some time now. Although they were overlooked by investors for the first two quarters of 2022, tech stocks have bounced back almost 15% since their lowest points in June, 2022. In this article we will go over two of the top tech stocks that you should watch closely; Laser Photonics Corporation (NASDAQ:LASE) and ForgeRock (NYSE: FORG). If you missed these stocks recent run up, don’t worry with our NASDAQ & NYSE Penny Stocks alerts you will never miss another one!

#1 TOP TECH STOCKS TO GET NOW: LASE

Laser Photonics Corporation (NASDAQ:LASE) is a leading global industrial development company that focuses on creating cleantech laser systems. The company has been making headlines since its IPO at the end of the last quarter. Just this morning, LASE increased 63% upon the news of a new order from the US Navy.

The stock first began trading on the 30th of September in the NASDAQ with a float of 3 million shares. Laser Photonics is planning on using the funding from the IPO to work on the first phases of its growth strategy. Which includes dominating the corrosion control market with LASE’s line of cleantech laser cleaning solutions.

The recent run up was caused by the company announcing a new order from the US Navy. The order is for LPC-1000CTH CleanTech Laser Blasting System with an integrated water chiller for submarine MRO (maintenance, repair and operations). It is also worth noting that the order is expected to be fulfilled this month. That could mean another major run up in the near future.

On that note, LASE’s CEO – Wayne Tupuola – said that they

We believe the U.S. Navy can benefit significantly from our CleanTech Laser Blasting systems in its $22 billion annual fight to control corrosion across the fleet. Over time, we hope to expand on this initial order as the U.S. Navy realizes our technology’s health, safety and efficiency benefits.

Following the news of the US Navy order, LASE witnessed a 63% run up and is currently trading at $3.09 with a newly formed resistance at 3.16. LASE has a primary support around 2.28 and a secondary stronger one near 1.91.

Accumulation started the day with a drastic increase, but it has cooled down a little since then. Meanwhile RSI is holding at 54, all the indicators are showing positive signs. A dip is expected soon but upon the news of the order fulfillment the stock might see a higher run up and break its resistance. Timing your entry in the next dip might make all the difference, as the stock might be trading at an all time high by the end of the year. If you want some help in choosing the best times to buy, sign up for our free alerts now and we will help you out!

$LASE 3.21!!! pic.twitter.com/AzMOj6pK6S

— Donnie Stocks (@DonnieStocks) October 11, 2022

Many investors including @DonnieStocks are bullish on the potential of the stock moving forward!

#2 TOP TECH STOCKS TO GET NOW: FORG

The second company to gain tremendous momentum today and be among the top tech stocks is ForgeRock (NYSE: FORG). As a global digital identity leader, FORG provides identity management products to serve numerous purposes including automating onboarding, progressive profiling, and relationship management.

Today, ForgeRock announced its entrance into a definitive agreement to be acquired by the software investment company – Thoma Bravo. Upon the news, the stock increased almost 50% in a couple of hours.

Thoma Bravo is a private equity investment firm with more than 40 years of expertise in providing capital and strategic support. As of Q2 2022, Thoma Bravo has over 70 companies in its portfolio and more than $122 billion of assets under its management. With that in mind, it’s easy to see why investors are bullish on the future of FORG.

Under the terms of the agreement, Thoma will acquire FORG for $23.25 per share in an all cash transaction. The whole transaction will amount to $2.3 billion. Bearing in mind that the stock was valued at $15 on October 10, meaning that the offer represents a 53% premium over the last closing price. Additionally, the transaction is planned to be finalized by Q2 2023 and upon the completion the stock will be delisted and FORG will become a privately held company.

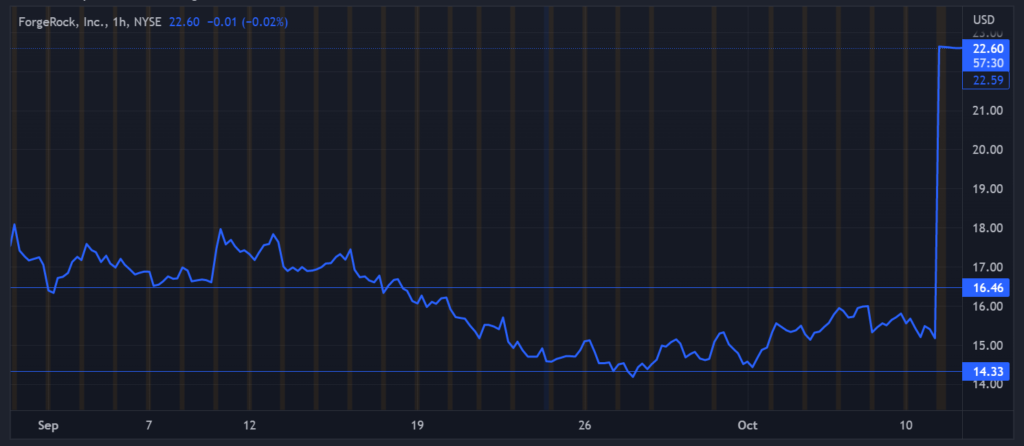

With a 49% increase, FORG is currently being traded at $22.6 which now acts as its new resistance. The stock has a primary support around 16.46 and a secondary support near 14.33.

MACD is on a bullish crossover with no signs of another crossover anytime soon. Meanwhile accumulation has been fluctuating and RSI is at 86, indicating that FORG is extremely overbought at the moment.

This might not be a good entry point with the stock trading far from its resistance. However with more news on the acquisition, FORG might skyrocket to be traded at its 52-week high of $36. FORG will be delisted by the second half of 2023, so it’s definitely not a long term play but with the right timing, it could make you a lot of money in its last few months.

BOTTOM LINE

Tech stocks like many other stocks are extremely volatile but with good DD, you can take advantage of the sector’s recent surge and make millions! It’s always good to keep the top tech stocks in your watchlist and maybe add some of them to your portfolio.

As always, good luck to all (except the shorts)!

WHEN VIRAL STOCKS HAS A STOCK ALERT, IT CAN PAY TO LISTEN. AFTER ALL, OUR FREE NEWSLETTER HAS FOUND MANY TRIPLE-DIGIT WINNERS FOR OUR SUBSCRIBERS. WE SPECIALIZE IN FINDING MOMENTUM BEFORE IT HAPPENS!

Disclosure: We have no business relationship with any company whose stock is mentioned in this article. Viral Stocks is not an investment advisor and this article does not provide investment advice. Always do your own research, make your own investment decisions, or consult with your nearest financial advisor. This article is not a solicitation or recommendation to buy, sell, or hold securities. This article is our opinion and is meant for informational and educational purposes only and does not provide investment advice. Past performance is not indicative of future performance.