The stock market started off hot this week with Tabula Rasa HealthCare, Convey Health Solutions, and Valneva on a major upward trend. The three medical stocks rapidly increased to reach new highs and are showing bullish signs moving forward. This article will analyze these stocks and the catalysts that drove their recent run-ups and put them on investors’ radar.

Convey Health Solutions Holdings Inc. (NYSE: CNVY)

As news of its new merger broke out, Convey Health Solutions Holdings Inc. (NYSE: CNVY) saw a massive 138% run up to trade at $10.3. Given that last week, CNVY closed at a PPS of $4.25, this price increase has caught the attention of many investors. Essentially a healthcare and technology company, CNVY has long focused its efforts on utilizing technologies to provide clients with premium healthcare solutions.

As of June 21st, CNVY announced it has entered into a definitive merger agreement with TPG Capital. Under the terms of the agreement, TPG Capital is set to acquire all common stock of CNVY in cash at a PPS of $10.50 – with a total enterprise value of nearly $1.1 billion.

Given that TPG Capital is a private equity platform owned by globally renowned alternative asset management firm – TPG, the news had a positive impact on the stock’s performance. In fact, the company’s board is bullish the merger will “provide substantial value, liquidity and certainty” for their shareholders.

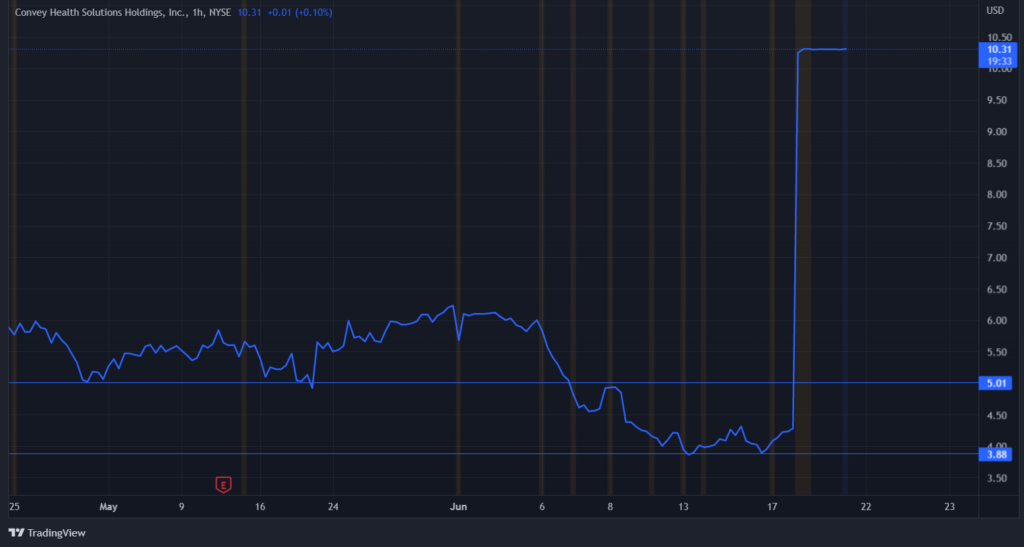

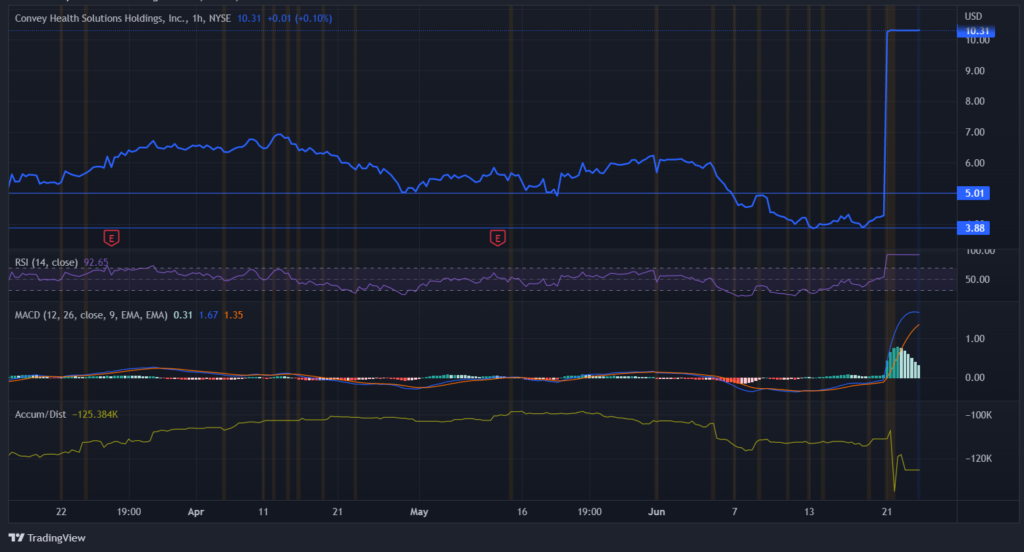

After its 135% run-up, CNVY is currently trading at $10.31 which also serves as the new resistance line. The stock has a primary support around 5.01 and a stronger secondary support at 3.88.

The RSI skyrocketed to 93 – indicating CNVY is extremely overbought. On the other hand, accumulation has been fluctuating and spent hours on a downward trend. However, it has been seeing a slight uptrend lately as an increasing number of investors hold onto their shares in anticipation of a higher run. In Meanwhile, the MACD is on a bullish crossover.

With plans to finalize the merger by Q2 2022, news could hit anytime soon resulting in a similar run up or a higher one. In light of this, many are bullish CNVY could run-up to break its newly formed resistance and trade at its 52-week high of $12.4.

Valneva SE (NASDAQ: VALN)

It is a great day for the investors of Valneva SE (NASDAQ: VALN) as the company just announced that its long-time partner – the internationally well-acclaimed pharmaceuticals company – Pfizer is planning on acquiring an 8.1% stake. VALN stock is to be acquired at a PPS of €9.49 with the total number reaching €90.5 million – equivalent to $95 million. Upon the news, the stock skyrocketed to break multiple resistance lines and trade at $26.5.

Back in 2020, both companies entered into a partnership to co-develop a vaccine for Lyme disease. Already in clinical development, this vaccine is the sole candidate for preventing this tick-borne infection. Currently, VALN and Pfizer are considering updating the terms of the initial agreement. The new terms will include a 10% increase in the study funding from VALN’s side. Accordingly, the company will pay tiered royalties up to 22% instead of the first agreed-upon 19%.

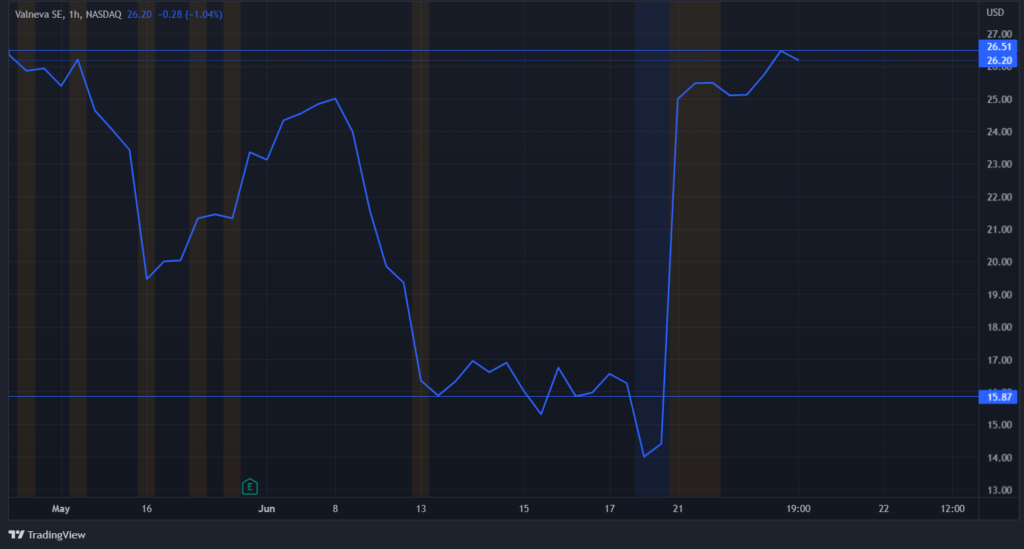

Following a 93% increase, VALN is currently trading at $26.2 with a newly formed resistance at 26.51 and a strong support near 15.07.

Most indicators are showing positive signs – with accumulation drastically increasing and MACD on a recent bullish crossover. However, RSI stands at 65 indicating VALN might be slightly overbought at the moment. In light of this, investors are bullish the stock has the potential to increase even more and trade at YTD high of $47.7. Get alerts & be the first to trade the best NYSE & NASDAQ Penny Stock Lists!

Tabula Rasa HealthCare, Inc. (NASDAQ: TRHC)

The third and last medical stock on our watchlist today is Tabula Rasa HealthCare, Inc. (NASDAQ: TRHC). As an emerging healthcare technology company, TRHC works on advancing the safe use of medication and reducing adverse drug events – the fourth cause of death in the US. TRHC increased 55% upon the market opening this morning. That spike was caused by the company announcing its entrance into an agreement with Transaction Data Systems (TDS).

Under the terms of the agreement, TRHC will sell its successful patient relationship management solution – Prescibe Wellness – to TDS. Commenting on that, the company’s CEO – Calvin H. Knowlton – said that this “ is a significant and strategic step forward in unlocking stockholder value.” He went on to say that he believes they found the perfect partner to “advance the future of pharmacy by leveraging these technologies.”

Investors are feeling bullish over this news and the potential of TRHC’s growth in the coming years. As a leading company in the pharmaceutical industry, TDS has operations in all 50 states and Puerto Rico – which could propel several expansions in the near future.

Although TRHC started off the day with a 55% run-up, the stock then lost some of its momenta and is currently trading at $3.03. TRHC has a primary resistance at 3.87 and a second one around 4, meanwhile, the support line stands at 2.58.

MACD is on a recent bullish crossover with no signs of another crossover anytime soon. Although RSI skyrocketed from 27 to 71 upon the news, it now holds at 51 while accumulation continues to heavily fluctuate. These indicators show that the run up was short lived. Despite that, investors remain bullish that as new of the company’s growth and new partnerships break out, the stock could go back to trading at over $20.

Bottom Line

Medical stocks have been gaining momentum for the past couple of years as a result of the Covid-19 outbreak – especially companies that work to utilize new technologies in providing the world with medical solutions. CNVY, VALN and TRHC all have catalysts that give them huge potential for growth in the near future. Wanna find the hottest NYSE, NASDAQ, and Penny stocks? Just Sign up here & we’ll make sure you’re the first to know!